Executive Summary

What is a Section 83(b) election?

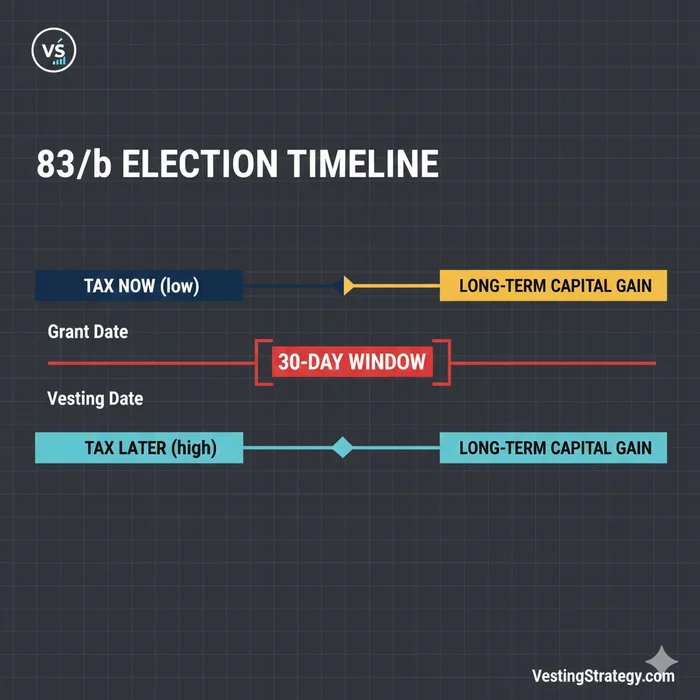

A Section 83(b) election is an IRS filing that lets you pay taxes on restricted stock at grant (when value is low) rather than at vesting (when value may be much higher). This converts future appreciation from ordinary income (up to 37%) to long-term capital gains (20%). You must file within 30 days of receiving the stock—no exceptions.

For tech professionals living abroad with US-granted equity, filing a Section 83(b) election within the absolute 30-day window is the single most effective way to lock in low grant-date valuations. This avoids future ordinary income tax rates of up to 37%.

The bottom line: A properly filed 83(b) election on early-stage startup equity can save $16,830+ per $500K exit. Savings scale proportionally with company growth. Failing to file is an irreversible mistake with no IRS remedies available.1

Critical Warning for Expats: The Foreign Earned Income Exclusion (Section 911 FEIE) does NOT reduce Alternative Minimum Tax exposure from ISO exercises. Many expat founders discover this too late—owing $90K+ in AMT on paper gains they never realized.2

The Non-Negotiable 30-Day Window

Unlike most IRS filings, the Section 83(b) election has an absolute, non-extensible deadline. There are no extensions, no reasonable cause exceptions, no "first-time penalty abatement."

Per Treasury Regulation §1.83-2, the election must be filed within 30 calendar days of the property transfer date.3

Figure 1: The 83(b) election timeline — file within 30 days of grant to lock in low tax basis and qualify for long-term capital gains treatment on future appreciation.

| Requirement | Specification |

|---|---|

| Deadline | 30 calendar days from property transfer (Board approval date) |

| Form | IRS Form 15620 (revised April 2025)4 |

| Signature | Original required; electronic signatures now permitted (June 2025 update) |

| Filing Location | IRS Service Center, Austin TX (for non-residents) |

| Delivery Method | Certified mail or IRS-designated private delivery (FedEx, DHL, UPS) |

| Copies Required | (1) IRS, (2) Employer, (3) Personal records |

The 30-day clock starts from the date of property transfer—typically the Board approval date, NOT the date you receive documentation. Many founders miss this distinction and file late.

Source: IRS Publication 525 – Taxable and Nontaxable Income

The Expat TIN Challenge: SSN vs ITIN

The most common friction point for non-US residents is the lack of a Taxpayer Identification Number. The IRS has not issued explicit guidance on whether non-US taxpayers can validly file 83(b) elections—but tax advisors widely recommend filing to preserve optionality.5

Three Filing Options for Non-US Persons

According to Baker Tax Law and Corpora, non-US persons have three viable options:

| Option | TIN Field Entry | Procedure | Risk Level |

|---|---|---|---|

| Option A | ITIN number | File Form W-7 simultaneously with 83(b) | Low (official channel) |

| Option B | "Applied For" | Include pending W-7 copy; update when ITIN received | Medium (procedural) |

| Option C | "N/A" or "Foreign Individual" | Include cover letter explaining non-resident status | Medium-High (one rejection reported) |

2026 Update: As of February 2024, the IRS has been returning Form W-7 applications noting that filing a Section 83(b) election alone is insufficient grounds for ITIN issuance. This creates procedural uncertainty—use Option B or C as fallback.6

Source: Stripe Atlas 83(b) Guide

Recommended Filing Procedure for Non-US Persons

- Prepare Form 15620 with all required information (grant date, FMV, vesting schedule)

- Insert "Applied for" or "Foreign Individual" in TIN field

- Attach cover letter explaining:

- Non-US tax resident status

- Possibility of becoming US taxpayer during vesting period

- Request for acceptance without TIN

- Mail via certified delivery to Austin TX Service Center

- Include self-addressed stamped envelope requesting date-stamped copy

- Retain all documentation for 7+ years

Source: Clerky Help Center

Tax Impact Quantification: The $100K Decision

The financial benefit of filing an 83(b) election scales with company appreciation. Using the widely-cited Cooley LLP methodology:7

Scenario Comparison: 100,000 Shares at $0.01 Grant Price

| Metric | With 83(b) Election | Without 83(b) Election | Difference |

|---|---|---|---|

| Grant Date FMV | $1,000 | $1,000 | — |

| Tax at Grant (37%) | $370 | $0 | +$370 |

| Vesting Date FMV | $100,000 | $100,000 | — |

| Tax at Vesting (37%) | $0 | $37,000 | -$37,000 |

| Exit Value ($5/share) | $500,000 | $500,000 | — |

| Capital Gain | $499,000 | $400,000 | — |

| Capital Gains Tax (20%) | $99,800 | $80,000 | +$19,800 |

| Total Tax Paid | $100,170 | $117,000 | -$16,830 |

| Net Proceeds | $399,830 | $383,000 | +$16,830 |

Key Insight: The savings of $16,830 represents a company that only grew from $0.01 to $5.00 per share. For high-growth startups reaching $50+ per share, the savings exceed $150,000 per 100,000 share grant.

Source: Cooley GO – Silicon Valley's leading startup law firm

The Mathematical Principle

83(b) Advantage = (FMV at Vest - FMV at Grant) × (Ordinary Rate - Cap Gains Rate)

For tech employees in the 37% federal bracket (plus California's 13.3%), the spread between ordinary income and long-term capital gains treatment can exceed 30 percentage points.

Source: Carta 83(b) Guide

The AMT Trap: Why FEIE Won't Save You

Does the Foreign Earned Income Exclusion (FEIE) reduce AMT from stock options?

No. The FEIE (Section 911) only excludes earned income like salary—it does NOT reduce Alternative Minimum Tax from ISO exercises. The entire ISO bargain element is included in AMTI regardless of your FEIE status. This is the #1 tax trap for expat founders.

This is the single most consequential tax trap for expat founders and option holders. Many assume that qualifying for the FEIE reduces their overall US tax exposure.

This assumption is dangerously incorrect for equity compensation.8

The FEIE-AMT Non-Interaction Problem

Per Secfi's analysis, the average ISO exercise generates AMT exposure equivalent to approximately 6.6x the strike price:9

| Tax Component | Regular Income Tax | Alternative Minimum Tax (AMT) |

|---|---|---|

| Salary Income | Reduced by FEIE ($130,000 excluded in 2025) | NOT reduced by FEIE |

| ISO Bargain Element | Not taxed until sale (if holding period met) | Included in FULL in AMTI |

| 83(b) Election Impact | Locks in grant-date value | Reduces AMT exposure by locking low basis |

Source: IRS Form 6251 Instructions – Alternative Minimum Tax

Numerical Example: The $90K Surprise

Scenario: US citizen living in Portugal, exercises 10,000 ISOs

| Data Point | Value |

|---|---|

| Strike Price | $10/share |

| FMV at Exercise | $50/share |

| Bargain Element | $400,000 |

| FEIE Exclusion Applied | $130,000 (on salary only) |

| Regular Income (after FEIE) | $20,000 |

| Regular Tax | $4,800 |

AMT Calculation:

| Step | Calculation | Amount |

|---|---|---|

| AMTI before bargain element | Salary + adjustments | $50,000 |

| Add: ISO bargain element | Full amount | $400,000 |

| Total AMTI | $450,000 | |

| Less: AMT exemption (single 2025) | ($88,100) | |

| Taxable AMTI | $361,900 | |

| AMT at 26% | $94,094 | |

| Less: Regular tax | ($4,800) | |

| AMT Owed | $89,294 |

The FEIE exclusion of $130,000 provides ZERO relief to this AMT calculation. The entire $400,000 bargain element is included in AMTI regardless of FEIE status.

Source: SmartAsset AMT Calculator

Expert Warning: The California Tail Tax

If you were a California resident when your equity was granted, California will claim a proportional share of your equity income even after you relocate to another state or country.10

The California Sourcing Formula

Per California Franchise Tax Board (FTB) guidance:

CA Taxable Amount = Total Equity Income × (CA Work Days ÷ Total Work Days)

The period measured runs from grant date to vesting date for RSUs, and grant date to exercise date for stock options.

Source: FTB Publication 1031 – Guidelines for Determining Resident Status

Impact on 83(b) Elections

| Factor | Impact |

|---|---|

| Filing 83(b) in California | Triggers immediate CA tax on grant-date value |

| Relocating before grant | Eliminates CA tail tax exposure |

| Relocating after grant, before vest | Prorated CA taxation based on days worked in CA |

| Stock Options vs RSUs | Options provide more flexibility (exercise date vs vest date) |

Strategic Consideration: If you're planning to leave California, consider timing equity grants for AFTER establishing residency elsewhere. New grants received post-relocation have zero California sourcing.

California Tail Tax Exposure Table

| Scenario | RSU Value | CA Portion | CA Tax (13.3%) |

|---|---|---|---|

| 4 years in CA, vest in CA | $100,000 | 100% | $13,300 |

| 2 years CA, 2 years TX | $100,000 | 50% | $6,650 |

| Grant in CA, immediate move to TX | $100,000 | ~5% | $665 |

| Grant AFTER moving to TX | $100,000 | 0% | $0 |

Form 8938: Foreign Asset Reporting for Expats

Expats holding foreign financial assets face mandatory disclosure requirements under FATCA. Critically, these thresholds are 4x higher for those living abroad than for US residents.11

Filing Thresholds (2025-2026)

Per IRS Form 8938 Instructions:

| Status | Year-End Value | Any Time During Year |

|---|---|---|

| US Residents (Single) | $50,000 | $75,000 |

| US Residents (MFJ) | $100,000 | $150,000 |

| Expats Abroad (Single) | $200,000 | $300,000 |

| Expats Abroad (MFJ) | $400,000 | $600,000 |

Key Point: Form 8938 filing is required regardless of whether you claim FEIE. These are independent compliance requirements.

Source: IRS.gov Form 8938 FAQ

Non-Compliance Penalties

| Violation | Penalty |

|---|---|

| Initial failure to file | $10,000 |

| Continued failure (per 30-day period) | $10,000 (cap: $50,000) |

| Accuracy-related (undisclosed asset) | 40% of underpayment |

| Fraud | 75% of underpayment |

| Statute of Limitations | Extended to 6 years if >$5K income omitted |

Source: 26 U.S. Code § 6038D

QSBS Exclusion: The $10M Tax-Free Exit

Section 1202 Qualified Small Business Stock provides up to 100% exclusion on capital gains—but comes with significant restrictions.12

QSBS Requirements

Per Morgan Stanley's QSBS analysis:

| Requirement | Specification |

|---|---|

| Holding Period | 5+ years from acquisition |

| Company Type | US C-Corporation only (no S-corps, LLCs) |

| Gross Assets | ≤$50M at time of issuance |

| Asset Use | 80%+ in active business (not passive/investment) |

| Exclusion Cap | Greater of $10M or 10× adjusted basis |

Source: 26 U.S. Code § 1202

State Non-Conformity Warning

QSBS exclusion is NOT available in:

- California

- New Jersey

- Pennsylvania

- Alabama

- Mississippi

This materially reduces QSBS benefits for founders in these states—particularly California, where state tax alone is 13.3%.

Source: RSM US QSBS Guide

Portugal: The 14% Effective Rate Alternative

For expats considering relocation, Portugal's Article 43-C EBF provides one of the world's most favorable startup equity tax treatments.13

Portugal Startup Equity Regime (2025-2026)

Per DLA Piper's analysis of Law no. 21/2023:

| Feature | Standard Treatment | Article 43-C Regime |

|---|---|---|

| Capital Gains Rate | 28% | 14% effective |

| Mechanism | Full taxation | 50% exemption |

| Holding Period | None | 1 year minimum |

| Company Requirement | Any | Startup/SME/R&D intensive |

Source: Portuguese Official Gazette – Law no. 21/2023

Qualifying Company Criteria

Companies must meet at least one condition:

- Registered startup status + SME classification or R&D intensity (10%+ of turnover)

- SME/Small-mid-cap classification (under 500 employees)

- R&D intensive (10%+ of expenses on R&D, patents, software)

Source: KPMG Portugal Tax Alert 2025

Tax Calculation Example

| Event | Standard Rate | Article 43-C Rate |

|---|---|---|

| Exercise at $10, FMV $50 | — | — |

| Sale at $100/share | — | — |

| Total gain | $90/share | $90/share |

| Taxable (after 50% exemption) | $90/share | $45/share |

| Tax at 28% | $25.20/share | $12.60/share |

| Effective Rate | 28% | 14% |

Source: PWC Portugal Tax Guide

2025-2026 AMT Parameters Reference

Per IRS Revenue Procedure 2024-40:

| Component | Single Filer | Married Filing Jointly |

|---|---|---|

| Lower Bracket Rate | 26% (first $239,100 AMTI) | 26% (first $239,100 AMTI) |

| Upper Bracket Rate | 28% (above $239,100) | 28% (above $239,100) |

| Exemption Amount | $88,100 | $137,650 |

| Phase-out Begins | $578,150 AMTI | $578,150 AMTI |

Strategic Timing for ISO Exercises

For expat option holders, timing ISO exercises strategically can minimize AMT exposure.

AMT Crossover Analysis

Per SmartAsset's crossover calculator:

| Regular Income | Approximate Bargain Element to Trigger AMT |

|---|---|

| $50,000 | ~$90,000 |

| $100,000 | ~$70,000 |

| $200,000 | ~$40,000 |

| $300,000+ | Most exercises trigger AMT |

Strategy: Exercise ISOs across multiple tax years, keeping each year's bargain element below your personal AMT crossover point.

Source: Brighton Jones AMT Guide

Filing Checklist: 83(b) Election for Non-US Persons

Based on guidance from Corpora and Stripe Atlas:

- ☐ Verify grant/transfer date (start 30-day clock)

- ☐ Complete Form 15620 with all required information

- ☐ Enter TIN, "Applied For," or "Foreign Individual" in TIN field

- ☐ Draft cover letter explaining non-resident status

- ☐ If no TIN: file Form W-7 simultaneously

- ☐ Calculate FMV at grant date (get 409A valuation from company)

- ☐ Make copy for employer

- ☐ Make copy for personal records

- ☐ Send via certified mail to Austin TX Service Center

- ☐ Include self-addressed stamped envelope for confirmation

- ☐ Track delivery confirmation

- ☐ Calendar follow-up in 45 days if no response

- ☐ Store all documentation for 7+ years

When NOT to File an 83(b) Election

The 83(b) election is not always optimal:

| Situation | Recommendation |

|---|---|

| Certain you'll never become US tax resident | Filing provides no US tax benefit |

| High grant-date valuation | May not want to accelerate tax recognition |

| Significant forfeiture risk | May pay tax on shares you never receive |

| Company likely to fail | Tax paid at grant is non-recoverable |

However, the asymmetric upside typically favors filing: the cost ($200-500 for professional services) is minimal compared to potential savings of $100K+.

Source: DWT Startup Law Blog

Frequently Asked Questions

Can I file an 83(b) election after the 30-day deadline?

No. The 30-day deadline is absolute and non-extensible per Treasury Regulation §1.83-2. There are no IRS remedies, no reasonable cause exceptions, and no penalty abatement options. If you miss the deadline, the election is permanently unavailable for that grant.

Source: 26 CFR § 1.83-2

Does the FEIE reduce my AMT from stock option exercises?

No. The Foreign Earned Income Exclusion applies only to earned income (wages, salary, self-employment income). The bargain element from ISO exercises is included in full in Alternative Minimum Taxable Income regardless of FEIE status.

Source: IRS Publication 54 – Tax Guide for U.S. Citizens Abroad

Can I file an 83(b) election without a Social Security Number?

Yes. Non-US persons can file using an ITIN, "Applied For" status (with pending W-7), or "N/A"/"Foreign Individual" in the TIN field with an explanatory cover letter. Tax advisors recommend filing to preserve optionality if there's any possibility of becoming a US tax resident during the vesting period.

Source: Baker Tax Law

What happens if my company fails after I file an 83(b)?

Any tax paid at grant is non-refundable. However, you may be able to claim a capital loss equal to your basis (the amount included in income) when the shares become worthless. This loss is subject to capital loss limitations ($3,000/year against ordinary income).

Source: IRS Publication 550 – Investment Income and Expenses

How do I calculate the fair market value (FMV) for my 83(b) election?

For private company stock, the FMV is typically the 409A valuation price set by the company's board. Request the most recent 409A valuation from your employer's stock administration team. For public companies, use the closing price on the grant date.

Source: IRS Revenue Ruling 59-60

Does filing an 83(b) election affect my state taxes?

Yes. State tax treatment varies significantly. California, for example, will still apply its "tail tax" to equity granted during California residency, even if you file an 83(b) and relocate. Some states like Texas, Florida, and Nevada have no state income tax on equity.

Source: FTB Publication 1031

Can I revoke an 83(b) election once filed?

No. Once you file a valid 83(b) election and the 30-day window closes, the election is irrevocable. You cannot undo it even if circumstances change (e.g., stock value drops significantly).

Source: Treasury Regulation §1.83-2(f)

What's the difference between 83(b) for RSAs vs ISOs vs NSOs?

- RSAs (Restricted Stock Awards): 83(b) elections are most common here—you pay tax on grant-date FMV and start the capital gains clock immediately.

- ISOs (Incentive Stock Options): 83(b) elections apply only to early-exercised ISOs. They can reduce AMT exposure but require careful planning. See our complete ISO vs NSO guide for detailed tax treatment.

- NSOs (Non-Qualified Stock Options): 83(b) only applies if you early-exercise unvested shares. The spread at exercise is always ordinary income.

Source: Cooley GO Stock Option Guide

Footnotes

Disclaimer: This guide discusses legal tax optimization strategies only. Tax evasion is illegal and is never recommended. This content is for educational purposes and does not constitute tax, legal, or financial advice. Tax laws vary by jurisdiction and change frequently. Always consult a qualified tax professional (CPA, tax attorney, enrolled agent) before making decisions based on this information. The authors accept no liability for actions taken based on this content.

Primary Sources

| Source | Type | URL |

|---|---|---|

| IRS Form 15620 | Official Form | irs.gov/pub/irs-pdf/f15620.pdf |

| IRS Form 8938 Instructions | Official Guidance | irs.gov/pub/irs-pdf/i8938.pdf |

| Treasury Reg. §1.83-2 | Regulation | law.cornell.edu/cfr/text/26/1.83-2 |

| 26 USC §911 | Statute | law.cornell.edu/uscode/text/26/911 |

| 26 USC §1202 | Statute | law.cornell.edu/uscode/text/26/1202 |

| Cooley LLP | Law Firm Guide | cooleygo.com |

| Baker Tax Law | Tax Advisory | mbakertaxlaw.com |

| Secfi | Research | secfi.com |

| DLA Piper | Portugal Analysis | dlapiper.com |

| Portuguese Law 21/2023 | Official Gazette | diariodarepublica.pt |

Last Updated: January 2026 | Research Team: VestingStrategy

Footnotes

-

Treasury Regulation §1.83-2 specifies the absolute 30-day filing requirement with no extension provisions. ↩

-

Secfi research indicates average ISO AMT exposure of 6.6× strike price. See Secfi ISO AMT Guide. ↩

-

26 CFR § 1.83-2 – Election to include in gross income in year of transfer. ↩

-

IRS Form 15620 – Section 83(b) Election (April 2025 revision). ↩

-

Baker Tax Law analysis on non-US person 83(b) filing procedures. ↩

-

Corpora 2024 Guide documents recent IRS W-7 rejections. ↩

-

Cooley GO – "Why Should You File a Section 83(b) Election?" ↩

-

NCEO analysis on AMT and stock options interaction. ↩

-

Secfi empirical research on average ISO AMT exposure. ↩

-

California Revenue & Taxation Code §17951 governs source-based taxation of equity compensation. ↩

-

IRS Form 8938 Instructions specify expatriate filing thresholds. ↩

-

26 U.S. Code § 1202 – Partial exclusion for gain from certain small business stock. ↩