Executive Summary

What is the difference between ISO and NSO stock options?

ISOs (Incentive Stock Options) receive preferential tax treatment—no regular income tax at exercise, and gains can qualify for long-term capital gains rates (max 20%). NSOs (Non-Qualified Stock Options) are taxed as ordinary income (up to 37%) at exercise on the spread between strike price and FMV. ISOs are employee-only; NSOs can go to contractors, advisors, and board members.

For tech professionals, stock options often represent the largest potential wealth-building opportunity—and the largest potential tax liability. Unlike RSUs which are taxed at vesting, the difference between Incentive Stock Options (ISO) and Non-Qualified Stock Options (NSO) can mean a 17 percentage point difference in federal tax rates (20% vs 37%), translating to $170,000+ in tax savings on a $1M gain.

The bottom line: ISOs offer superior tax treatment but come with AMT risk and strict holding requirements. NSOs provide flexibility and predictable taxation but at ordinary income rates. Your optimal strategy depends on your income level, liquidity needs, and risk tolerance.1

Critical Warning: The $100,000 annual ISO limit catches many employees by surprise. Any ISOs that become exercisable above this threshold automatically convert to NSOs—regardless of what your grant agreement says.2

The Fundamental Distinction

Incentive Stock Options (ISO)

ISOs are "statutory" stock options that meet specific requirements under IRC Section 422. They exist solely to provide tax benefits to employees.3

| Requirement | Specification |

|---|---|

| Eligible Recipients | Employees only (no contractors, advisors, or directors) |

| Employment Requirement | Must exercise within 3 months of leaving (12 months if disabled) |

| Strike Price | Must be ≥ 100% of FMV at grant (110% for >10% shareholders) |

| Term | Maximum 10 years (5 years for >10% shareholders) |

| Annual Limit | $100,000 FMV becoming exercisable per year |

| Plan Approval | Shareholder approval required within 12 months |

Source: 26 U.S. Code § 422

Non-Qualified Stock Options (NSO)

NSOs (also called NQSOs or NQOs) are "non-statutory" options that don't meet IRC Section 422 requirements. They're the default option type and offer maximum flexibility.4

| Characteristic | Specification |

|---|---|

| Eligible Recipients | Anyone: employees, contractors, advisors, directors |

| Employment Requirement | None (terms set by agreement) |

| Strike Price | Any price (but 409A compliance required) |

| Term | Any duration (commonly 10 years) |

| Annual Limit | None |

| Plan Approval | Board approval sufficient |

Source: IRS Publication 525

Tax Treatment: The Complete Lifecycle

When are stock options taxed?

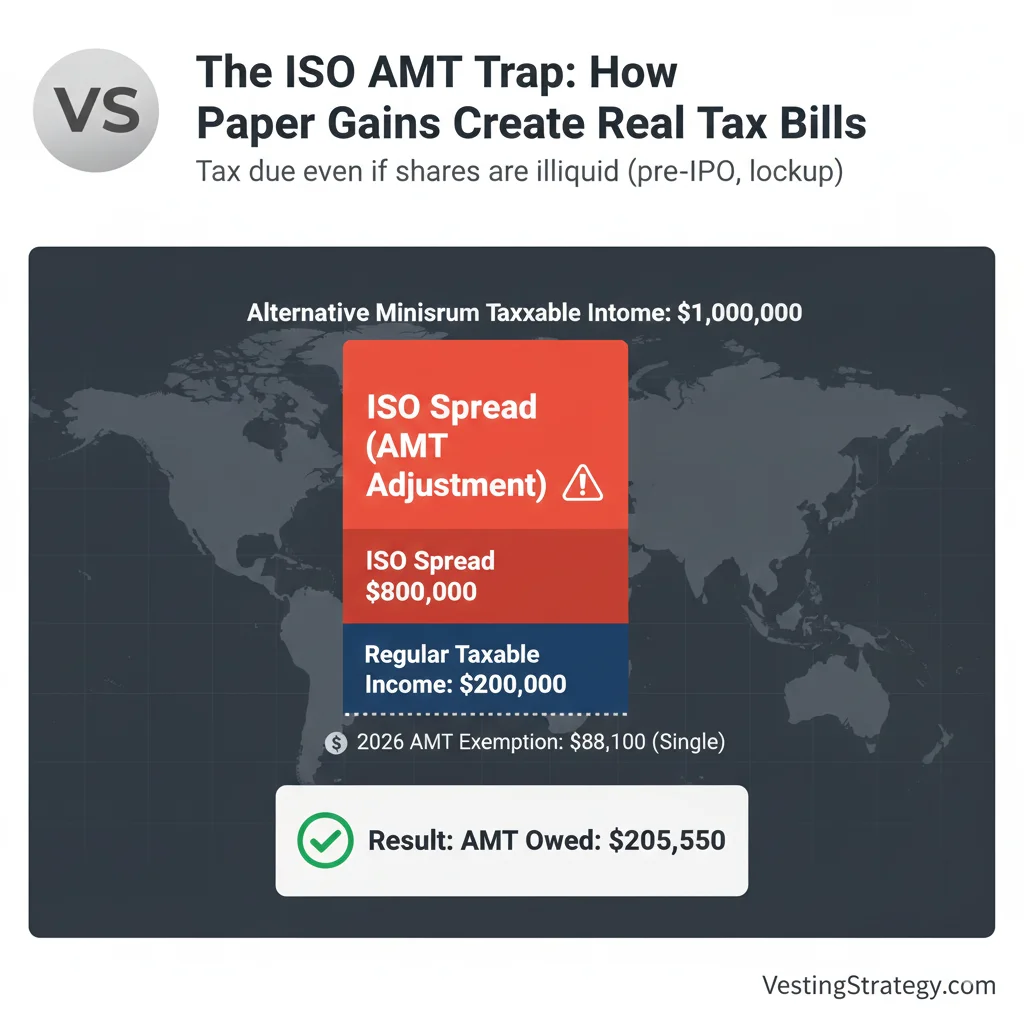

Grant and vesting: No tax for either ISO or NSO. Exercise: ISOs have no regular tax (but AMT may apply); NSOs trigger ordinary income tax on the spread. Sale: ISOs get capital gains treatment if holding periods are met; NSOs pay capital gains only on appreciation after exercise.

Figure 1: ISO vs NSO tax timeline — ISOs defer taxation until sale (with AMT risk at exercise), while NSOs trigger ordinary income tax immediately at exercise.

Side-by-Side Tax Comparison

| Event | ISO Tax Treatment | NSO Tax Treatment |

|---|---|---|

| Grant | No tax | No tax (if 409A compliant) |

| Vesting | No tax | No tax |

| Exercise | No regular income tax | Ordinary income tax on spread |

| AMT adjustment on spread | Withholding required (22-37%) | |

| No withholding required | Reported on W-2 | |

| Sale (Qualifying) | Long-term capital gains (0-20%) | Long-term capital gains on post-exercise appreciation |

| Sale (Disqualifying) | Ordinary income on spread | N/A |

The Spread Calculation

The "spread" (also called "bargain element") is the foundation of all stock option taxation:

Spread = (Fair Market Value at Exercise - Strike Price) × Number of Shares

Example: You exercise 10,000 options with a $2 strike price when FMV is $50:

- Spread = ($50 - $2) × 10,000 = $480,000

- For NSOs: $480,000 taxed as ordinary income at exercise

- For ISOs: $480,000 is an AMT adjustment (potential AMT liability)

Source: Treasury Regulation § 1.83-7

ISO Holding Periods: The 2/1 Rule

To achieve a Qualifying Disposition with ISOs—where the entire gain is taxed at long-term capital gains rates—you must satisfy two independent holding periods:5

Figure 2: The ISO 2/1 Rule — both holding period conditions must be satisfied for qualifying disposition treatment. Failing either triggers ordinary income taxation.

The Two Clocks

| Clock | Requirement | Starts From |

|---|---|---|

| Clock 1 | Hold for 2+ years | Grant date |

| Clock 2 | Hold for 1+ year | Exercise date |

Both clocks must be satisfied before selling to qualify for preferential tax treatment.

Qualifying vs Disqualifying Dispositions

| Disposition Type | Tax Treatment | When It Applies |

|---|---|---|

| Qualifying | Entire gain taxed at LTCG (0-20%) | Both 2-year and 1-year tests met |

| Disqualifying | Spread at exercise → Ordinary income | Either test failed |

| Post-exercise gain → Capital gains |

Numerical Example: The $85,000 Difference

Scenario: 10,000 ISOs, $2 strike, exercised at $20 FMV, sold at $50

| Tax Scenario | Spread ($180K) | Post-Exercise Gain ($300K) | Total Tax | Effective Rate |

|---|---|---|---|---|

| Qualifying Disposition | $0 (included in CG) | $480K × 23.8% | $114,240 | 23.8% |

| Disqualifying Disposition | $180K × 37% = $66,600 | $300K × 23.8% = $71,400 | $138,000 | 28.8% |

| Difference | $23,760 | 5% |

Note: 23.8% = 20% LTCG + 3.8% NIIT for high earners. Actual savings increase significantly at higher income levels due to state taxes.

Source: Cooley GO

The $100,000 ISO Limit: The Hidden Trap

What is the $100K ISO limit?

Under IRC 422(d), only $100,000 worth of ISOs (measured by FMV at grant date) can become exercisable for the first time in any calendar year. Any excess is automatically treated as NSOs, triggering ordinary income tax at exercise. This limit applies regardless of what your grant agreement says.

How the Limit Works

The $100,000 limit is calculated based on:

- The Fair Market Value at grant date (not exercise date)

- Options first becoming exercisable in a given year

- Applied in grant order (oldest grants first)

Example: The Automatic NSO Conversion

Scenario: You receive 50,000 ISOs at $5 FMV with standard 4-year monthly vesting

| Year | Shares Vesting | FMV at Grant | Value Becoming Exercisable | Treatment |

|---|---|---|---|---|

| Year 1 | 12,500 | $5 | $62,500 | ISO ✓ |

| Year 2 | 12,500 | $5 | $62,500 | ISO ✓ |

| Year 3 | 12,500 | $5 | $62,500 | ISO ✓ |

| Year 4 | 12,500 | $5 | $62,500 | ISO ✓ |

Same scenario with cliff vesting (25% after Year 1):

| Year | Shares Vesting | FMV at Grant | Value Becoming Exercisable | Treatment |

|---|---|---|---|---|

| Year 1 | 12,500 | $5 | $62,500 | ISO ✓ |

| Year 1 (cliff) | +12,500 | $5 | +$62,500 = $125,000 | $25,000 → NSO |

Key insight: Cliff vesting can inadvertently push you over the $100K limit. The excess $25,000 worth of options automatically become NSOs.6

Strategies to Manage the $100K Limit

| Strategy | How It Works | Best For |

|---|---|---|

| Negotiate vesting schedule | Request monthly vesting without cliff | New hires with large grants |

| Split grants across years | Receive smaller grants in consecutive years | Ongoing equity refreshes |

| Early exercise | Exercise before options become exercisable | Early-stage startups |

| Accept NSO treatment | Plan for ordinary income taxation | High-income employees |

Source: IRC Section 422(d)

Alternative Minimum Tax (AMT): The ISO Tax Trap

Do ISOs trigger AMT?

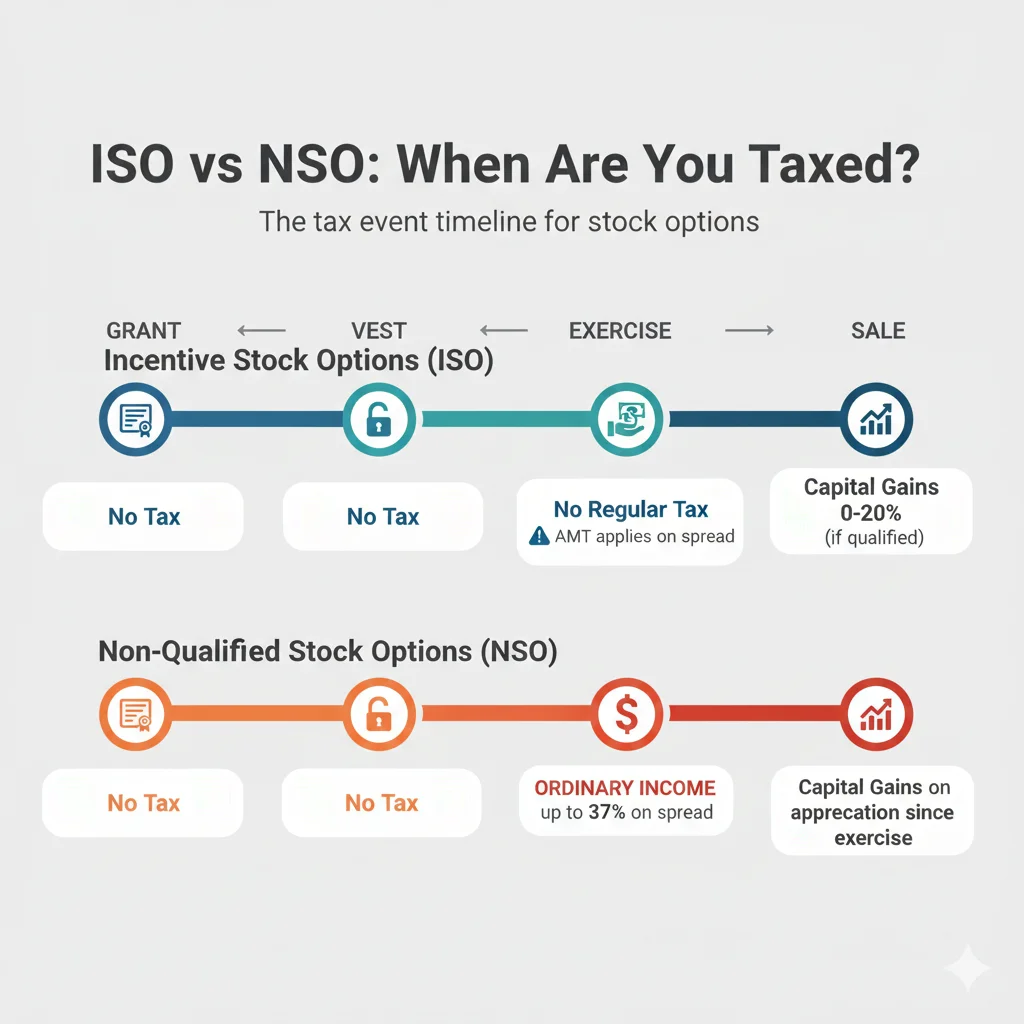

Yes. While ISOs have no regular income tax at exercise, the spread (FMV minus strike price) is an AMT adjustment item. If your Alternative Minimum Taxable Income exceeds the exemption amount, you'll owe AMT at 26-28% on paper gains—even if you can't sell the shares. This has caused six-figure surprise tax bills for tech employees.

Figure 3: The ISO AMT Trap — exercising ISOs with large spreads can create six-figure tax bills on paper gains you can't yet realize.

How ISO Exercise Triggers AMT

The ISO spread is added to your regular taxable income to calculate AMTI (Alternative Minimum Taxable Income). If AMTI exceeds the exemption, you pay the higher of regular tax or AMT.7

2026 AMT Parameters

| Component | Single Filer | Married Filing Jointly |

|---|---|---|

| Exemption Amount | $88,100 | $137,650 |

| 26% Bracket | First $239,100 of AMTI | First $239,100 of AMTI |

| 28% Bracket | AMTI above $239,100 | AMTI above $239,100 |

| Phase-out Begins | $626,350 AMTI | $1,252,700 AMTI |

Source: IRS Revenue Procedure 2025-XX

AMT Calculation Example

Scenario: Single filer, $200K salary, exercises 20,000 ISOs with $40 spread

| Line Item | Amount |

|---|---|

| Regular Taxable Income | $200,000 |

| ISO Spread (AMT adjustment) | $800,000 |

| Alternative Minimum Taxable Income (AMTI) | $1,000,000 |

| Less: AMT Exemption | ($88,100) |

| Taxable AMTI | $911,900 |

| AMT at 26% (first $239,100) | $62,166 |

| AMT at 28% (remaining $672,800) | $188,384 |

| Tentative Minimum Tax | $250,550 |

| Less: Regular Tax (~$45,000) | ($45,000) |

| AMT Owed | $205,550 |

The trap: You owe $205,550 in tax on shares you may not be able to sell (pre-IPO, lockup, etc.).8

The AMT Credit: Recovering Your Overpayment

AMT paid on ISO exercises creates an AMT Credit (Form 8801) that can be recovered in future years when your regular tax exceeds AMT. This is often overlooked, leaving thousands on the table.9

| Year | Regular Tax | Tentative AMT | Tax Owed | AMT Credit Used | Carryforward |

|---|---|---|---|---|---|

| Exercise Year | $45,000 | $250,550 | $250,550 | $0 | $205,550 |

| Year 2 | $60,000 | $55,000 | $60,000 | $5,000 | $200,550 |

| Year 3 | $80,000 | $50,000 | $80,000 | $30,000 | $170,550 |

Source: IRS Form 8801 Instructions

ISO vs NSO: Decision Framework

When ISOs Are Better

| Situation | Why ISO Wins |

|---|---|

| High-growth startup | Maximum upside taxed at 20% vs 37% |

| Low current income | Less AMT exposure |

| Long hold intention | Can satisfy 2/1 holding periods |

| Early exercise possible | Lock in low FMV, start capital gains clock |

When NSOs Are Better

| Situation | Why NSO Wins |

|---|---|

| High current income | Already in AMT, ISO benefit reduced |

| Need immediate liquidity | No holding period required for optimal tax |

| Contractor/advisor | ISOs not legally available |

| Company unlikely to IPO | Tax benefit of ISO uncertain |

| Risk-averse | Predictable tax bill at exercise |

Quick Decision Matrix

| Your Profile | Recommended | Reasoning |

|---|---|---|

| Engineer at Series A startup, $150K salary | ISO | High growth potential, low AMT risk |

| Senior exec at pre-IPO, $500K+ comp | NSO (or strategic ISO exercise) | Already in AMT territory |

| Contractor at any stage | NSO | Only legal option |

| Any employee needing cash at exercise | NSO | Same-day sale without penalty |

Exercise Strategies by Option Type

ISO Exercise Strategies

| Strategy | Description | Best For | Risk Level |

|---|---|---|---|

| Exercise & Hold | Exercise, pay AMT, hold for LTCG | Believers in company, low AMT exposure | High |

| AMT Optimization | Exercise up to AMT crossover point annually | High earners with patience | Medium |

| Same-Day Sale | Exercise and sell immediately (disqualifying) | Need liquidity | Low |

| Early Exercise + 83(b) | Exercise unvested, file 83(b) | Early employees, low FMV | Medium |

NSO Exercise Strategies

| Strategy | Description | Best For | Risk Level |

|---|---|---|---|

| Same-Day Sale | Exercise and sell immediately | Liquidity needs | Low |

| Exercise & Hold | Exercise, pay tax, hold for LTCG on future gains | Believers in continued growth | Medium |

| Cashless Exercise | Broker finances exercise, sells enough to cover | No cash available | Low |

| Net Exercise | Company withholds shares for taxes | Simplicity | Low |

Source: Carta Equity Education

International Considerations for Expats

Sourcing Rules (IRC 861-865)

For employees who work in multiple countries during the grant-to-exercise period, stock option income is sourced based on workday apportionment:10

US-Source Income = Total Spread × (US Workdays ÷ Total Workdays from Grant to Exercise)

Example: US-to-UK Move

Scenario: Granted ISOs while US employee, moved to UK after 2 years, exercised after 4 years

| Period | Location | Workdays |

|---|---|---|

| Year 1-2 | US | 500 days |

| Year 3-4 | UK | 500 days |

| Total | 1,000 days |

US-Source Percentage: 500 ÷ 1,000 = 50%

If the spread at exercise is $400,000:

- US taxes $200,000 (50%)

- UK may also tax, with relief via tax treaty

Planning tip: Some expats relocate to tax-favorable jurisdictions like Portugal (with its 14% effective rate on startup equity) or the UAE (0% personal income tax) to optimize their equity taxation.

ISO Eligibility for Non-US Persons

| Scenario | ISO Eligibility | Notes |

|---|---|---|

| US citizen abroad | ✓ Eligible | Full ISO treatment available |

| Green card holder abroad | ✓ Eligible | Employment test still applies |

| Non-resident alien, US employer | ✓ Eligible | Must be employee, not contractor |

| Non-resident alien, non-US employer | ⚠️ Complex | Depends on plan structure |

Source: Baker Tax Law

Compliance and Reporting Requirements

Employer Reporting

| Form | Option Type | Deadline | Contains |

|---|---|---|---|

| Form 3921 | ISO | Jan 31 (following year) | Exercise details for AMT calculation |

| Form 3922 | ESPP | Jan 31 (following year) | ESPP purchase details |

| W-2 | NSO | Jan 31 (following year) | Spread reported as ordinary income |

Employee Reporting

| Form | When Required | Purpose |

|---|---|---|

| Form 6251 | ISO exercise | Calculate AMT exposure |

| Form 8949 | Any sale | Report capital gains/losses |

| Schedule D | Any sale | Summary of capital gains |

| Form 8801 | Year after AMT paid | Claim AMT credit |

Source: IRS Form 3921 Instructions

Common Mistakes to Avoid

ISO Mistakes

- ❌ Exercising without AMT analysis — Can trigger six-figure surprise tax bills

- ❌ Selling before holding periods met — Loses entire ISO tax advantage

- ❌ Ignoring the $100K limit — Options silently convert to NSOs

- ❌ Forgetting the AMT credit — Leaving money on the table for years

- ❌ Waiting too long after leaving — Must exercise within 3 months of termination

NSO Mistakes

- ❌ Not planning for withholding — 22% may be insufficient for high earners

- ❌ Incorrect cost basis on sale — Double taxation if broker reports $0 basis

- ❌ Exercising in high-income year — Stacks on top of salary at marginal rate

- ❌ Letting options expire — No tax benefit if underwater or forgotten

Frequently Asked Questions

Can I have both ISOs and NSOs?

Yes, and it's common. Many companies grant ISOs up to the $100K limit and the excess as NSOs. You may also have ISOs that converted to NSOs due to the 3-month post-termination rule.

Source: Cooley GO

What happens to my ISOs if I leave the company?

You typically have 90 days (3 months) from your last day of employment to exercise ISOs. After that, unexercised ISOs expire. If you exercise after 90 days but within the option term, they're treated as NSOs.

Source: IRC Section 422(a)(2)

Can I do a same-day sale with ISOs?

Yes, but it triggers a disqualifying disposition. The spread at exercise becomes ordinary income, eliminating the ISO tax advantage. You'd effectively have NSO tax treatment.

Source: IRS Publication 525

How do I know if my options are ISOs or NSOs?

Check your stock option agreement and grant notice. ISOs must be explicitly designated as "Incentive Stock Options" under IRC Section 422. If not specified, they're NSOs by default.

Does California tax ISOs differently?

California does not conform to federal ISO treatment. The spread at exercise is taxable for California purposes regardless of holding period. California also doesn't recognize the AMT credit carryforward the same way. Additionally, if you relocate from California, you may still face California's source-based taxation (tail tax) on equity granted during your residency.

Source: FTB Publication 1001

Can contractors receive ISOs?

No. ISOs are legally restricted to employees under IRC Section 422. Contractors, advisors, and board members can only receive NSOs.

What's the tax impact if my company gets acquired?

Acquisition typically triggers accelerated vesting. For ISOs:

- Cash acquisition = immediate tax event (disqualifying disposition if holding periods not met)

- Stock-for-stock = may qualify for tax-free exchange under IRC 424

Source: IRC Section 424

Should I early exercise my options?

Early exercise (before vesting) can be advantageous for ISOs when FMV is low. Combined with an 83(b) election, it starts both the capital gains clock and the ISO holding periods immediately. However, you risk paying tax on shares you might forfeit if you leave.

Source: See our Section 83(b) Election Guide

ISO vs NSO Comparison Checklist

Before making exercise decisions, verify:

For ISOs:

- ☐ Confirm options are designated as ISOs in grant agreement

- ☐ Calculate $100K limit impact across all grants

- ☐ Run AMT projection with current year income

- ☐ Verify employment status (must be employee or within 3 months of leaving)

- ☐ Track both holding period clocks (2 years from grant, 1 year from exercise)

- ☐ Check if early exercise is available and beneficial

- ☐ Plan for potential disqualifying disposition scenarios

For NSOs:

- ☐ Calculate spread × marginal tax rate for exercise cost

- ☐ Verify employer withholding is sufficient (may need to supplement)

- ☐ Document cost basis for future sales

- ☐ Consider timing: high vs. low income years

- ☐ Evaluate same-day sale vs. exercise and hold

Footnotes

Disclaimer: This guide discusses legal tax optimization strategies only. Tax evasion is illegal and is never recommended. This content is for educational purposes and does not constitute tax, legal, or financial advice. Tax laws vary by jurisdiction and change frequently. Always consult a qualified tax professional (CPA, tax attorney, enrolled agent) before making decisions based on this information. The authors accept no liability for actions taken based on this content.

Primary Sources

| Source | Type | URL |

|---|---|---|

| IRC Section 422 | Statute | law.cornell.edu/uscode/text/26/422 |

| IRC Section 83 | Statute | law.cornell.edu/uscode/text/26/83 |

| Treasury Reg. § 1.422-2 | Regulation | law.cornell.edu/cfr/text/26/1.422-2 |

| IRS Publication 525 | Official Guidance | irs.gov/publications/p525 |

| Form 6251 Instructions | Official Guidance | irs.gov/pub/irs-pdf/i6251.pdf |

| Form 3921 Instructions | Official Guidance | irs.gov/pub/irs-pdf/i3921.pdf |

| Form 8801 Instructions | Official Guidance | irs.gov/pub/irs-pdf/i8801.pdf |

| Cooley GO | Law Firm Guide | cooleygo.com/stock-options-101/ |

| Carta Equity Education | Platform Guide | carta.com/learn/equity/stock-options/ |

Last Updated: January 2026 | Research Team: VestingStrategy

Footnotes

-

The 17 percentage point difference represents the maximum federal spread between ordinary income (37%) and long-term capital gains (20%) for top earners. ↩

-

IRC Section 422(d) establishes the $100,000 limitation, calculated based on fair market value at grant date. ↩

-

Treasury Regulation § 1.422-2 provides detailed requirements for ISO qualification. ↩

-

NSOs are governed by IRC Section 83 (property transferred in connection with performance of services). ↩

-

IRC Section 422(a)(1) specifies the dual holding period requirements for qualifying dispositions. ↩

-

The $100K limit applies based on options "first becoming exercisable" in a calendar year, making vesting schedule design critical. ↩

-

Form 6251 Instructions detail how ISO exercises create AMT preference items. ↩

-

This scenario illustrates why AMT planning is essential before large ISO exercises. ↩

-

IRC Section 53 establishes the AMT credit for prior year minimum tax liability. ↩

-

Treasury Regulations under IRC Sections 861-865 govern the sourcing of compensation income for international taxpayers. ↩