Executive Summary

How do I avoid AMT when exercising ISO stock options?

Calculate your AMT crossover point: Available AMT Headroom ÷ (Bargain per share × 28%). Exercise only enough shares to stay below this threshold. Alternatively, coordinate ISO exercises with high ordinary income years (RSU vesting, NSO exercises) where regular tax exceeds AMT, or use a disqualifying disposition (exercise and sell same year) to avoid AMT entirely—though this triggers ordinary income tax.

For tech employees exercising Incentive Stock Options (ISOs), the Alternative Minimum Tax (AMT) represents the single largest tax risk—creating six-figure tax bills on paper gains you can't yet sell (pre-IPO, lockup periods, illiquid shares). For a complete comparison of ISO vs NSO tax treatment, see our ISO vs NSO Stock Options Guide.

The bottom line: AMT applies to the ISO "bargain element" (spread between exercise price and FMV) via Form 6251 line 2i, even though no regular income tax is due at exercise. A properly calculated crossover point lets you exercise strategically without triggering AMT. AMT credits paid are recoverable indefinitely via Form 8801—a benefit often overlooked, leaving thousands on the table.1

Critical Warning: The 2026 OBBBA changes accelerate AMT phaseouts to 50 cents per dollar (vs 25 cents in 2025), lowering phaseout thresholds significantly. This increases AMT exposure for high earners exercising large ISO positions.2

Understanding the AMT Mechanism for ISOs

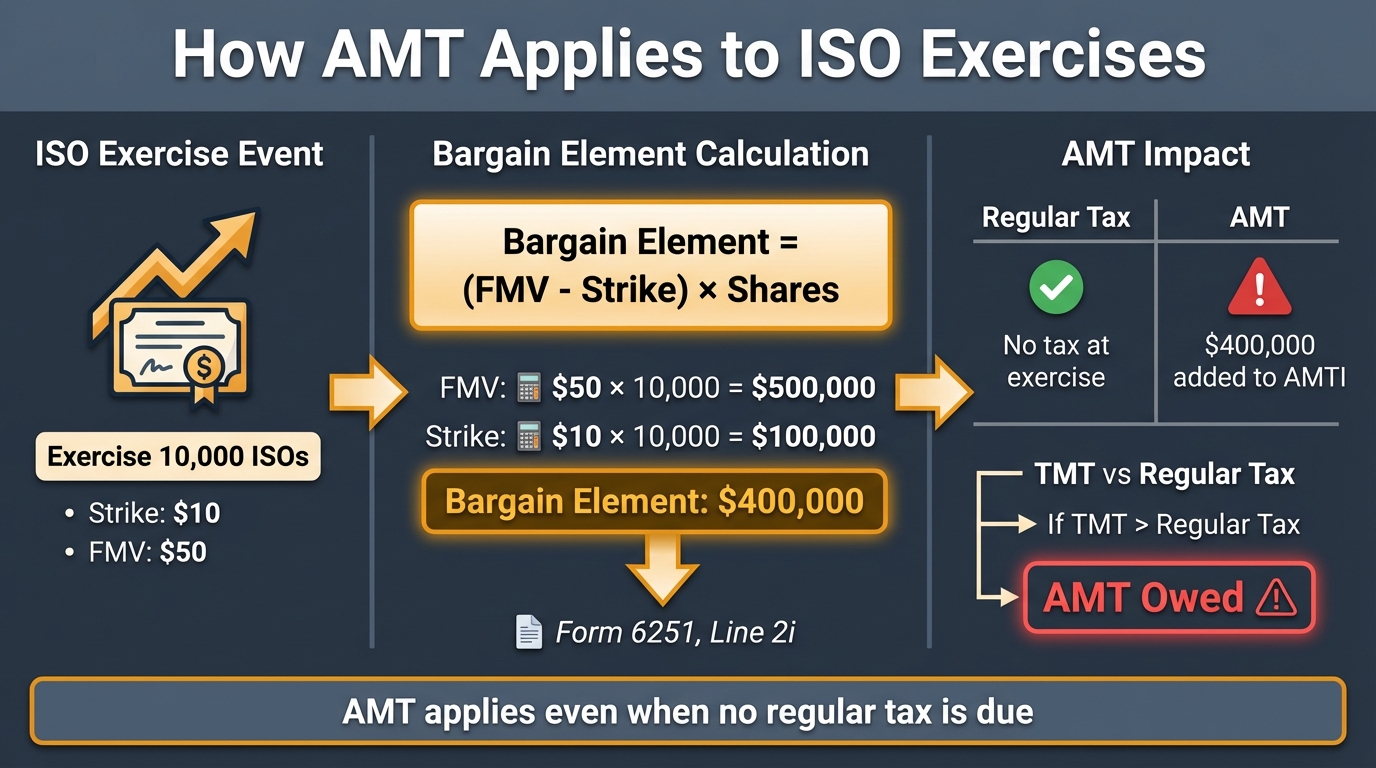

What is the Bargain Element?

The bargain element (also called "spread" or "ISO adjustment") is the foundation of AMT exposure from ISO exercises. Per IRC Section 56(b)(3), this amount is added to your Alternative Minimum Taxable Income (AMTI) even though it's not recognized for regular tax purposes.3

Formula:

Bargain Element = (Fair Market Value at Exercise - Exercise Price) × Number of Shares

Example: The $400,000 Bargain Element

Scenario: You exercise 10,000 ISOs with a $10 strike price when FMV is $50 per share.

| Component | Calculation | Amount |

|---|---|---|

| Exercise Price | $10 × 10,000 shares | $100,000 |

| FMV at Exercise | $50 × 10,000 shares | $500,000 |

| Bargain Element | $500,000 - $100,000 | $400,000 |

This $400,000 is reported on Form 6251, line 2i as an AMT adjustment item, regardless of whether you can sell the shares.4

Source: IRC Section 56(b)(3)

How AMT is Calculated

Unlike regular tax, AMT uses a parallel tax system with different rates and exemptions:

| Tax System | Regular Tax | Alternative Minimum Tax (AMT) |

|---|---|---|

| ISO Exercise | No tax (deferred until sale) | Bargain element added to AMTI |

| Tax Rates | 10-37% (graduated) | 26% (first $239,100) + 28% (above) |

| Exemption | Standard deduction | AMT exemption (phases out) |

| Result | $0 tax at exercise | AMT may be due on paper gains |

Key Insight: AMT applies when your Tentative Minimum Tax (TMT) exceeds your regular tax liability. The bargain element increases AMTI, potentially pushing you into AMT territory even if your regular income is modest. Unlike NSOs which trigger ordinary income tax at exercise, ISOs defer regular tax but create AMT exposure—see our ISO vs NSO comparison for the full breakdown.5

Figure 1: The AMT mechanism for ISO exercises — how the bargain element (spread) triggers Alternative Minimum Tax even when no regular income tax is due at exercise.

Source: IRS Form 6251 Instructions

2025-2026 AMT Exemption Amounts and Phaseouts

What are the 2026 AMT exemption amounts?

For 2026: Single filers $90,100 (phaseout begins at $500,000 AMTI), Married Filing Jointly $140,200 (phaseout begins at $1,000,000 AMTI). The phaseout rate increases to 50 cents per dollar of AMTI exceeding the threshold (vs 25 cents in 2025), meaning exemptions phase out twice as fast under OBBBA changes.

The AMT exemption provides a buffer before AMT applies, but it phases out at higher income levels. The 2026 OBBBA changes significantly increase AMT exposure by accelerating phaseouts and lowering thresholds.

2025 AMT Parameters

| Filing Status | Exemption Amount | Phaseout Begins | Phaseout Rate |

|---|---|---|---|

| Single/Head of Household | $88,100 | $626,350 AMTI | 25¢ per dollar |

| Married Filing Jointly | $137,000 | $1,252,700 AMTI | 25¢ per dollar |

| Married Filing Separately | $68,500 | $626,350 AMTI | 25¢ per dollar |

Source: IRS Revenue Procedure 2024-40

2026 AMT Parameters (OBBBA Changes)

| Filing Status | Exemption Amount | Phaseout Begins | Phaseout Rate |

|---|---|---|---|

| Single/Head of Household | $90,100 | $500,000 AMTI | 50¢ per dollar |

| Married Filing Jointly | $140,200 | $1,000,000 AMTI | 50¢ per dollar |

| Married Filing Separately | ~$70,100 | $500,000 AMTI | 50¢ per dollar |

Critical Change: Phaseout thresholds decrease while phaseout rates double, meaning:

- Exemptions phase out twice as fast in 2026

- AMT applies to lower income levels than 2025

- ISO exercises are more likely to trigger AMT in 2026

Source: OBBBA 2026 AMT Changes

Phaseout Calculation Example

Scenario: Married Filing Jointly, $1,200,000 AMTI in 2026

| Step | Calculation | Amount |

|---|---|---|

| AMTI | $1,200,000 | |

| Less: Phaseout threshold | ($1,000,000) | |

| Excess AMTI | $200,000 | |

| Phaseout reduction | $200,000 × 50% | $100,000 |

| Exemption amount | $140,200 | $140,200 |

| Less: Phaseout reduction | ($100,000) | |

| Available Exemption | $40,200 |

Impact: The exemption is reduced from $140,200 to $40,200, significantly increasing AMT exposure.6

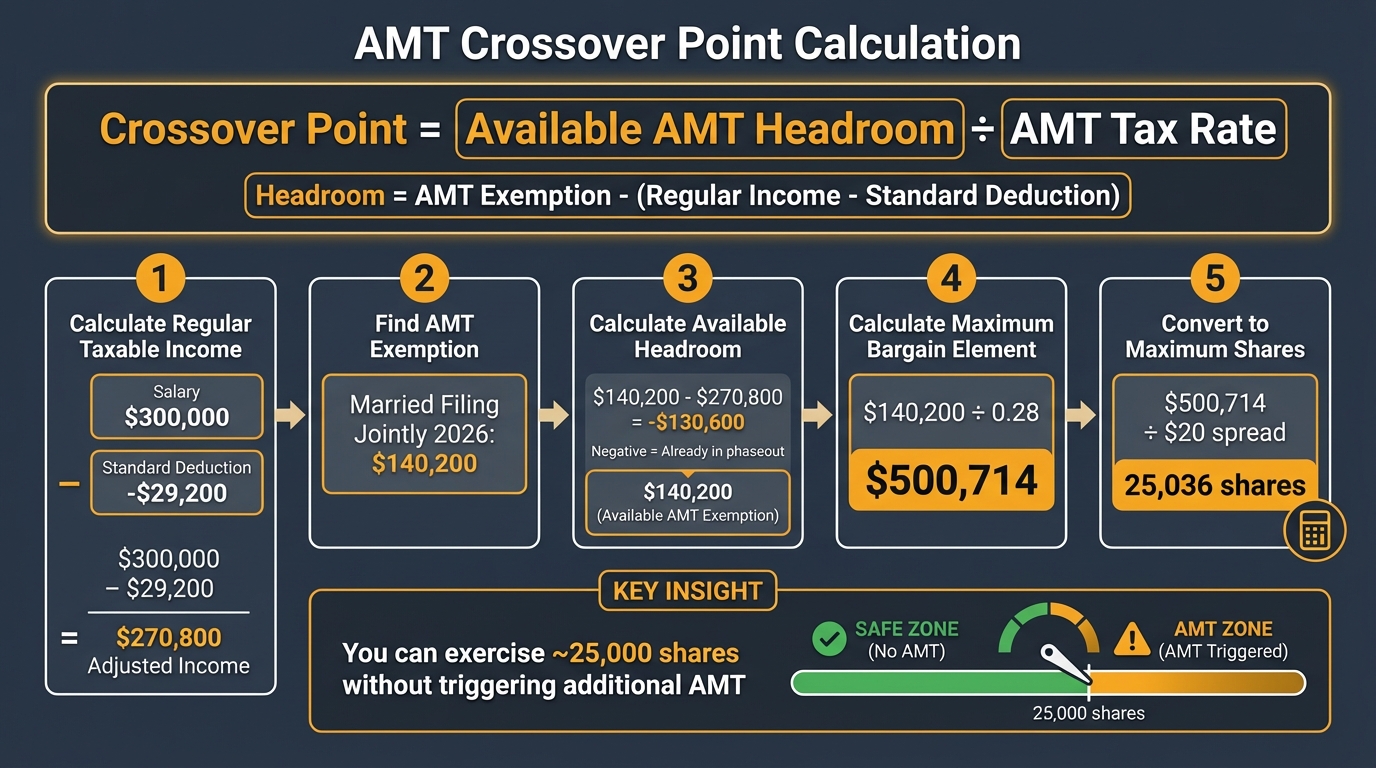

The AMT Crossover Point: Your Exercise Limit

How many ISO shares can I exercise without triggering AMT?

Calculate your crossover point: Available AMT Headroom ÷ (Bargain per share × 28%). Headroom = AMT Exemption - (Regular Taxable Income - Standard Deduction). This gives you the maximum bargain element you can generate without triggering AMT. Divide by your spread per share to get the maximum number of shares.

The AMT crossover point is the maximum bargain element you can generate from ISO exercises before your Tentative Minimum Tax (TMT) exceeds regular tax. This is your exercise limit for avoiding AMT.

The Crossover Point Formula

Crossover Point (in dollars) = Available AMT Headroom ÷ AMT Tax Rate

Where:

Available AMT Headroom = AMT Exemption - (Regular Taxable Income - Standard Deduction)

AMT Tax Rate = 28% (for most high earners)

Converting to Shares

To determine how many shares you can exercise:

Maximum Shares = Crossover Point ÷ Bargain Element per Share

Where:

Bargain Element per Share = FMV at Exercise - Exercise Price

Detailed Calculation Example

Scenario: Married Filing Jointly, 2026

- Regular taxable income: $300,000

- Standard deduction: $29,200

- Exercise price: $5 per share

- FMV at exercise: $25 per share

- Bargain per share: $20

| Step | Calculation | Amount |

|---|---|---|

| Regular taxable income | $300,000 | |

| Less: Standard deduction | ($29,200) | |

| Adjusted taxable income | $270,800 | |

| AMT exemption (MFJ 2026) | $140,200 | |

| Less: Adjusted taxable income | ($270,800) | |

| Headroom (negative = phaseout) | ($130,600) |

Result: Negative headroom means you're already in phaseout territory. You'll need to calculate AMT with phaseout reduction.

Revised Calculation with Phaseout:

| Step | Calculation | Amount |

|---|---|---|

| AMTI (before ISO) | $270,800 | $270,800 |

| AMT exemption | $140,200 | $140,200 |

| Less: Phaseout (if applicable) | ($0 - below threshold) | |

| Available exemption | $140,200 | |

| Maximum bargain element | $140,200 ÷ 0.28 | $500,714 |

| Maximum shares | $500,714 ÷ $20 | 25,036 shares |

Key Insight: You can exercise approximately 25,000 shares without triggering additional AMT beyond what you'd already owe on regular income.7

Figure 2: The AMT crossover point calculation — determine how many ISO shares you can exercise without triggering AMT by calculating available headroom and dividing by your spread per share.

Source: IRS Form 6251 Instructions

The $200K+ AMT Trap: Real-World Example

How much AMT can I owe on ISO exercises?

AMT on ISO exercises can easily exceed $200,000 for large positions. Example: $400,000 bargain element on 10,000 shares creates $112,000+ AMT at 28% rate. With phaseouts and higher spreads, six-figure AMT bills are common—even when shares are illiquid and you can't sell to pay the tax.

The AMT trap becomes most dangerous when exercising large ISO positions with significant spreads. Here's a realistic scenario:

Scenario: The $205,550 AMT Bill

Profile: Single filer, $200,000 salary, exercises 20,000 ISOs

| Component | Value |

|---|---|

| Exercise Price | $10 per share |

| FMV at Exercise | $50 per share |

| Shares Exercised | 20,000 |

| Bargain Element | $800,000 |

AMT Calculation:

| Step | Calculation | Amount |

|---|---|---|

| Regular Taxable Income | Salary | $200,000 |

| ISO Bargain Element (AMT adjustment) | ($50 - $10) × 20,000 | $800,000 |

| Alternative Minimum Taxable Income (AMTI) | $1,000,000 | |

| Less: AMT Exemption (Single 2026) | ($90,100) | |

| Taxable AMTI | $909,900 | |

| AMT at 26% (first $239,100) | $239,100 × 26% | $62,166 |

| AMT at 28% (remaining $670,800) | $670,800 × 28% | $187,824 |

| Tentative Minimum Tax (TMT) | $249,990 | |

| Less: Regular Tax (~$45,000) | ($45,000) | |

| AMT Owed | $204,990 |

The trap: You owe $204,990 in AMT on shares you may not be able to sell (pre-IPO, lockup, illiquid). This creates a cash flow crisis—tax due April 15th on gains you haven't realized.8

Source: IRS Form 6251 Instructions

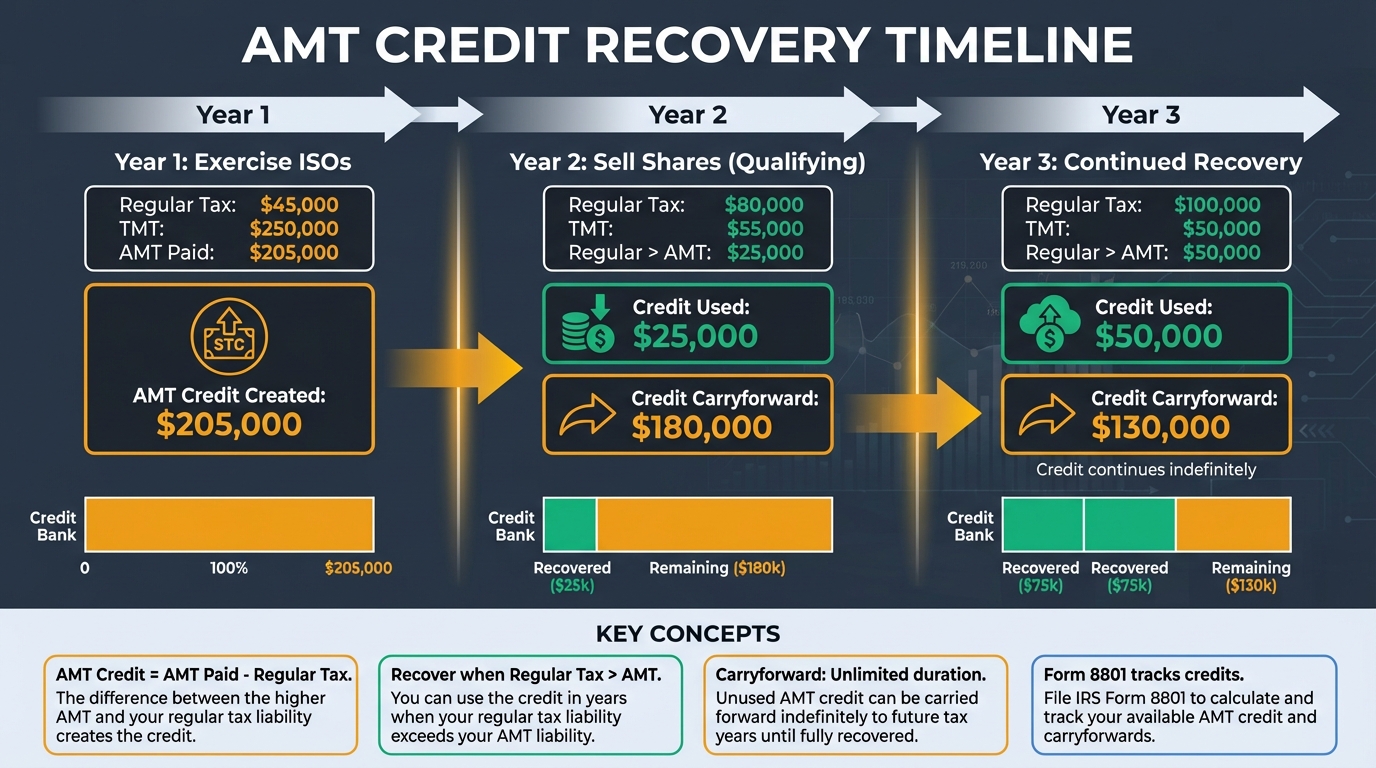

AMT Credit Recovery: The Overlooked Benefit

Can I recover AMT paid on ISO exercises?

Yes. AMT paid on ISO exercises creates an AMT credit (Form 8801) that carries forward indefinitely. You recover it when your regular tax exceeds AMT in future years—typically when you sell ISO shares in a qualifying disposition. The credit is unlimited in duration and can be worth tens of thousands of dollars.

One of the most overlooked aspects of AMT planning is the AMT credit—money you've "overpaid" that can be recovered in future years. Many employees never claim these credits, leaving thousands on the table.

How AMT Credits Work

Per IRC Section 53 and Treasury Regulation §1.53-1, AMT credits arise when you pay AMT in excess of your regular tax liability. For ISO exercises, this happens because the bargain element is included in AMTI but not in regular taxable income.9

Credit Generation:

AMT Credit = AMT Paid - Regular Tax Paid (in the exercise year)

Recovery Mechanism

AMT credits are recoverable when your regular tax exceeds AMT in a future year. This typically happens when you:

- Sell ISO shares in a qualifying disposition (long-term capital gains)

- Have high ordinary income in a future year (regular tax > AMT)

- Realize capital gains that push regular tax above AMT

Formula:

Credit Used = Regular Tax - Tentative Minimum Tax (when regular > AMT)

AMT Credit Recovery Example

Year 1 (Exercise Year):

- Regular Tax: $45,000

- Tentative Minimum Tax: $250,000

- AMT Paid: $205,000

- AMT Credit Created: $205,000

Year 2 (Sale Year - Qualifying Disposition):

- Regular Tax: $80,000 (includes capital gains)

- Tentative Minimum Tax: $55,000

- Credit Used: $25,000

- Credit Carryforward: $180,000

Year 3:

- Regular Tax: $100,000

- Tentative Minimum Tax: $50,000

- Credit Used: $50,000

- Credit Carryforward: $130,000

Key Insight: The credit carries forward indefinitely until fully utilized. Strategic sales of appreciated ISO shares can accelerate recovery.10

Source: IRS Form 8801 Instructions

The Negative Adjustment Acceleration

When you sell ISO shares in a qualifying disposition, you get a negative AMT adjustment on Form 6251 line 2k. This adjustment equals the difference between:

- AMT basis (FMV at exercise, used for AMT)

- Regular tax basis (exercise price, used for regular tax)

Example:

- Exercise price: $10

- FMV at exercise: $50 (AMT basis)

- Sale price: $100

| Tax System | Basis | Gain | Tax |

|---|---|---|---|

| Regular Tax | $10 | $90 | $18,000 (20% LTCG) |

| AMT | $50 | $50 | $10,000 (20% LTCG) |

| Negative Adjustment | $40 | Accelerates credit recovery |

This negative adjustment can accelerate AMT credit recovery significantly.11

Figure 3: AMT credit recovery timeline — how credits created from ISO exercises are recovered over multiple years via Form 8801 when regular tax exceeds AMT, typically accelerated by qualifying dispositions.

Source: Treasury Regulation §1.53-1

Strategic Timing: When to Exercise ISOs

Early-Year Exercise Strategy

Exercising ISOs in January through March provides several advantages:

| Benefit | Explanation |

|---|---|

| Time to monitor | Full tax year to assess stock performance and plan sales |

| Holding period start | Begins the 1-year holding clock for qualifying disposition |

| Tax planning window | 12+ months to coordinate with other income events |

| Disqualifying option | Can sell before year-end if needed (disqualifying disposition) |

Risk: Stock may decline, leaving you with AMT paid on higher FMV than current value.

Spreading Exercises Across Years

Rather than exercising all ISOs in one year, spread exercises across multiple years to:

- Stay below your crossover point annually

- Preserve AMT exemptions each year

- Manage cash flow for AMT payments

- Reduce concentration risk

Example Strategy:

- Year 1: Exercise 10,000 shares (below crossover)

- Year 2: Exercise 10,000 shares (below crossover)

- Year 3: Exercise remaining shares

This avoids a single-year AMT spike while maintaining flexibility.12

Source: IRS Publication 525

Low-Spread Exercise Opportunities

Exercising when the spread is minimal (FMV near exercise price) minimizes the bargain element, reducing AMT exposure.

Example:

- Exercise price: $0.05

- FMV at exercise: $0.06

- Bargain element: $0.01 per share

vs.

- Exercise price: $0.05

- FMV at exercise: $5.00

- Bargain element: $4.95 per share

99× difference in AMT exposure for the same number of shares.13

Coordinating with High-Income Years

Exercising ISOs in years with high ordinary income (RSU vesting, bonuses, NSO exercises) can minimize AMT because:

- Regular tax is already high (32-37% bracket)

- AMT rate is flat 26-28%

- Gap between regular tax and AMT narrows

Strategy: Time ISO exercises to coincide with RSU vesting or large bonus years.14

Disqualifying Disposition: The AMT Avoidance Strategy

Does selling ISO shares early avoid AMT?

Yes. A disqualifying disposition (selling before meeting the 2-year-from-grant and 1-year-from-exercise holding periods) avoids AMT on the bargain element. However, it triggers ordinary income tax on the bargain element instead. This is often preferable if AMT would exceed ordinary income tax, or if you need liquidity immediately.

A disqualifying disposition occurs when you sell ISO shares before meeting both holding period requirements:

- 2 years from grant date

- 1 year from exercise date

Tax Treatment Comparison

| Disposition Type | Regular Tax | AMT Treatment |

|---|---|---|

| Qualifying | Long-term capital gains on full gain | No AMT adjustment; prior AMT may generate credit |

| Disqualifying (Same Year) | Ordinary income on bargain element + capital gain/loss | Avoids AMT on bargain element |

| Disqualifying (Later Year) | Ordinary income on bargain element in sale year | May reverse prior AMT adjustment |

When Disqualifying Makes Sense

| Scenario | Why Disqualifying Wins |

|---|---|

| AMT > Ordinary Income Tax | Pay 37% ordinary vs 28% AMT + future credit uncertainty |

| Need immediate liquidity | Can't wait for holding periods |

| Stock price declining | Lock in gains before further decline |

| Avoiding AMT cash flow crisis | Can't afford AMT payment on illiquid shares |

Example Calculation:

Scenario: $400,000 bargain element, 37% marginal rate

| Strategy | Tax Treatment | Tax Owed |

|---|---|---|

| Qualifying (Hold) | AMT at 28% on $400K | $112,000 AMT (credit later) |

| Disqualifying (Sell) | Ordinary income at 37% on $400K | $148,000 regular tax |

Result: Disqualifying costs $36,000 more in tax, but provides immediate liquidity and certainty vs. AMT credit recovery uncertainty.15

Source: IRC Section 422(a)

Advanced Strategies: Coordinating ISO, RSU, and NSO

Strategy 1: NSO Offset for High Earners

Exercising NSOs in the same year as ISOs can minimize AMT because NSO ordinary income (taxed at 32-37%) exceeds the AMT rate (28%).

Mechanism:

- NSO spread = Ordinary income (high regular tax)

- ISO spread = AMT adjustment (28% AMT)

- High regular tax from NSO "absorbs" AMT from ISO

Example:

- NSO exercise: $300,000 spread → $111,000 regular tax (37%)

- ISO exercise: $200,000 spread → $56,000 AMT (28%)

- Regular tax ($111K) > AMT ($56K) → No additional AMT owed

Key Requirement: Must be in 32%+ bracket for this to work effectively.16

Source: IRS Publication 525

Strategy 2: RSU Vesting Coordination

Timing ISO exercises to coincide with RSU vesting can minimize AMT:

| Approach | How It Works |

|---|---|

| High-income year | RSU vesting creates high regular tax, narrowing gap with AMT |

| Low-income year | Exercise ISOs when RSUs aren't vesting to preserve exemptions |

| Staggered approach | Alternate years: RSU vesting vs. ISO exercises |

Example:

- Year 1: $500K RSU vesting → High regular tax

- Year 2: Exercise ISOs → AMT may be lower relative to Year 1 regular tax

Strategy 3: Early Exercise + 83(b) Election

For early-stage startups with low FMV, early exercise combined with a Section 83(b) election can:

- Lock in minimal bargain element (near-zero spread)

- Start both capital gains clock and ISO holding periods

- Minimize future AMT exposure as company grows

Risk: Paying tax on shares you might forfeit if you leave before vesting.17

Source: See our Section 83(b) Election Guide

California AMT: The Non-Conformity Problem

California does not conform to federal AMT treatment for ISOs, creating additional complexity:

| Aspect | Federal | California |

|---|---|---|

| ISO Exercise | No regular tax, AMT on bargain element | Ordinary income tax on bargain element |

| AMT Credit | Unlimited carryforward | Limited carryforward (different rules) |

| Qualifying Disposition | Long-term capital gains | Long-term capital gains (but basis differs) |

Impact: California taxes the ISO spread as ordinary income regardless of holding period, while federal defers taxation until sale (with AMT adjustment).18

Source: FTB Publication 1001

AMT Planning Checklist

Before exercising ISOs, complete this checklist:

Pre-Exercise Planning:

- ☐ Calculate your AMT crossover point for current year

- ☐ Project regular taxable income (salary, RSU, other income)

- ☐ Determine available AMT headroom (exemption - adjusted income)

- ☐ Calculate maximum bargain element you can generate

- ☐ Divide by spread per share to get maximum shares to exercise

- ☐ Model AMT vs. regular tax scenarios

- ☐ Plan cash flow for potential AMT payment (April 15th)

Exercise Strategy:

- ☐ Exercise early in tax year (Jan-Mar) if possible

- ☐ Stay below crossover point or coordinate with high-income year

- ☐ Consider disqualifying disposition if AMT > ordinary income tax

- ☐ Document exercise date and FMV for Form 3921

Post-Exercise:

- ☐ Track AMT basis vs. regular tax basis for future sales

- ☐ File Form 6251 with your tax return

- ☐ Calculate AMT credit created (Form 8801)

- ☐ Plan future sales to accelerate credit recovery

- ☐ Monitor stock performance for optimal sale timing

Frequently Asked Questions

How much AMT will I owe on my ISO exercise?

AMT depends on your bargain element, regular taxable income, and AMT exemption. Use this formula: (AMTI - Exemption) × 28% - Regular Tax. For a $400,000 bargain element with $200K salary (single filer), expect approximately $90,000-$110,000 in AMT.

Source: IRS Form 6251 Instructions

Can I avoid AMT by exercising fewer shares?

Yes. Calculate your crossover point and exercise only enough shares to stay below it. This requires knowing your regular taxable income, AMT exemption, and spread per share.

Source: IRS Form 6251 Instructions

How long can I carry forward AMT credits?

AMT credits carry forward indefinitely with no expiration. You can recover them in any future year when your regular tax exceeds AMT, typically when selling ISO shares or having high ordinary income.

Source: Treasury Regulation §1.53-1

Does selling ISO shares early avoid AMT?

Yes, a disqualifying disposition (selling before meeting holding periods) avoids AMT on the bargain element. However, it triggers ordinary income tax instead. This is often preferable if AMT would exceed ordinary income tax or if you need immediate liquidity.

Source: IRC Section 422(a)

Can I recover AMT credits if I never sell my ISO shares?

AMT credits can be recovered when regular tax exceeds AMT in any future year, not just from ISO sales. High ordinary income years (salary, RSU vesting, other capital gains) can trigger credit recovery.

Source: IRS Form 8801 Instructions

What happens to AMT if my company stock drops after exercise?

You still owe AMT on the exercise-date FMV, even if the stock declines. However, you may be able to claim a capital loss when you sell (subject to $3,000/year limitation against ordinary income). The AMT credit remains recoverable.

Source: IRS Publication 550

How do 2026 OBBBA changes affect AMT planning?

2026 changes accelerate phaseouts (50 cents/dollar vs 25 cents) and lower phaseout thresholds, increasing AMT exposure. This makes crossover point calculations more critical and may require exercising fewer shares or coordinating with high-income years.

Source: IRS Revenue Procedure 2025-XX

Should I exercise ISOs in a high-income year or low-income year?

It depends. High-income years can minimize AMT relative to regular tax (narrowing the gap). Low-income years preserve AMT exemptions. Model both scenarios—often, spreading exercises across years is optimal.

Source: IRS Publication 525

What's the difference between AMT basis and regular tax basis for ISOs?

AMT basis = FMV at exercise (used for AMT calculations on sale). Regular tax basis = Exercise price (used for regular tax calculations on sale). The difference creates a negative AMT adjustment on qualifying dispositions, accelerating credit recovery.

Source: IRS Form 6251 Instructions

Can I use AMT credits to offset regular tax in future years?

Yes, but only when regular tax exceeds AMT. The credit reduces your regular tax liability dollar-for-dollar up to the amount of the credit. Credits carry forward indefinitely until fully utilized.

Source: IRS Form 8801 Instructions

Footnotes

Disclaimer: This guide discusses legal tax optimization strategies only. Tax evasion is illegal and is never recommended. This content is for educational purposes and does not constitute tax, legal, or financial advice. Tax laws vary by jurisdiction and change frequently. Always consult a qualified tax professional (CPA, tax attorney, enrolled agent) before making decisions based on this information. The authors accept no liability for actions taken based on this content.

Primary Sources

| Source | Type | URL |

|---|---|---|

| IRC Section 56(b)(3) | Statute | law.cornell.edu/uscode/text/26/56 |

| IRC Section 53 | Statute | law.cornell.edu/uscode/text/26/53 |

| IRC Section 422(a) | Statute | law.cornell.edu/uscode/text/26/422 |

| Treasury Reg. §1.53-1 | Regulation | law.cornell.edu/cfr/text/26/1.53-1 |

| IRS Form 6251 Instructions | Official Guidance | irs.gov/pub/irs-pdf/i6251.pdf |

| IRS Form 8801 Instructions | Official Guidance | irs.gov/pub/irs-pdf/i8801.pdf |

| IRS Publication 525 | Official Guidance | irs.gov/publications/p525 |

| IRS Revenue Procedure 2024-40 | Official Guidance | irs.gov/pub/irs-drop/rp-24-40.pdf |

| FTB Publication 1001 | State Guidance | ftb.ca.gov/forms/misc/1001.pdf |

Last Updated: January 2026 | Research Team: VestingStrategy

Footnotes

-

IRC Section 56(b)(3) requires the ISO bargain element to be included in Alternative Minimum Taxable Income, creating AMT exposure even when no regular tax is due. ↩

-

The 2026 OBBBA (Omnibus Budget Reconciliation Act) changes accelerate AMT phaseouts to 50 cents per dollar, doubling the rate from 2025's 25 cents per dollar. ↩

-

IRC Section 56(b)(3) specifies that the spread between exercise price and FMV at exercise is an AMT adjustment item. ↩

-

IRS Form 6251 Instructions detail the reporting of ISO bargain elements on line 2i. ↩

-

AMT applies when Tentative Minimum Tax (TMT) exceeds regular tax liability, calculated on Form 6251. ↩

-

Phaseout calculations reduce the AMT exemption by 25 cents (2025) or 50 cents (2026) per dollar of AMTI exceeding the threshold. ↩

-

The crossover point represents the maximum bargain element that can be generated before TMT exceeds regular tax, allowing strategic exercise planning. ↩

-

Large ISO exercises with significant spreads can create six-figure AMT liabilities on illiquid shares, creating cash flow crises. ↩

-

IRC Section 53 establishes the AMT credit for prior year minimum tax liability. ↩

-

Treasury Regulation §1.53-1 governs AMT credit computation and carryovers, with no expiration under current rules. ↩

-

Negative AMT adjustments on qualifying dispositions accelerate credit recovery by creating larger gaps between regular tax and AMT. ↩

-

Spreading ISO exercises across multiple years helps manage AMT exposure while preserving annual exemptions. ↩

-

Early exercise when FMV is near exercise price minimizes bargain element, reducing AMT exposure significantly. ↩

-

Coordinating ISO exercises with high ordinary income years (RSU vesting, bonuses) can minimize AMT by narrowing the gap between regular tax and AMT. ↩

-

IRC Section 422(a) defines qualifying vs. disqualifying dispositions, with different tax treatments for each. ↩

-

NSO exercises generate ordinary income taxed at high rates (32-37%), which can exceed AMT rates (28%), minimizing net AMT exposure when coordinated with ISO exercises. ↩

-

Early exercise combined with Section 83(b) elections can lock in low FMV, minimizing future AMT exposure as company valuation increases. ↩

-

California Revenue & Taxation Code does not conform to federal AMT treatment, taxing ISO spreads as ordinary income regardless of holding periods. ↩