Executive Summary

How do I maximize my ESPP discount and avoid double taxation?

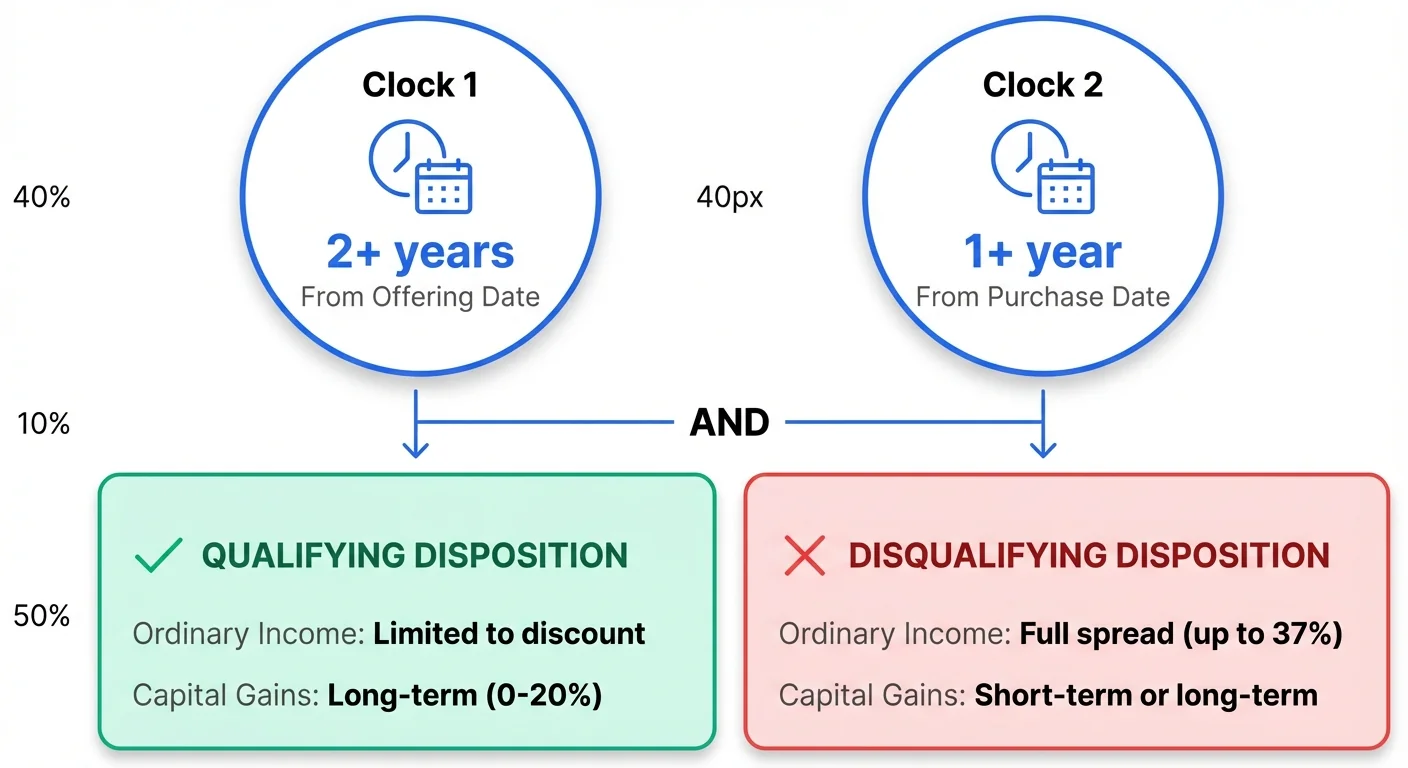

Hold ESPP shares for at least 2 years from the offering date AND 1 year from the purchase date to achieve a qualifying disposition. This limits ordinary income tax to the lesser of your discount (up to 15%) or actual gain, with the remainder taxed as long-term capital gains (0-20% vs up to 37% ordinary). Always adjust your Form 1099-B cost basis using Form 3922 to include W-2 income—this prevents double taxation on the discount portion.

Employee Stock Purchase Plans (ESPPs) are arguably the most powerful wealth-building tools in a modern compensation package. By allowing you to purchase company stock at a discount, they provide a "triple win": immediate equity, potential "lookback" price protection, and significant tax-deferred growth.

However, the complexity of IRS Section 423 rules means that many employees inadvertently trigger double taxation or forfeit lower capital gains rates. This guide provides an ultra-comprehensive breakdown of how to navigate ESPP taxation in 2026 to ensure you keep the maximum amount of your hard-earned gains.1

Related Guides: If you're comparing ESPPs with other equity compensation, see our guide on ISO vs NSO stock options. For expats managing ESPP taxation across borders, check our Portugal NHR 2.0 equity guide.

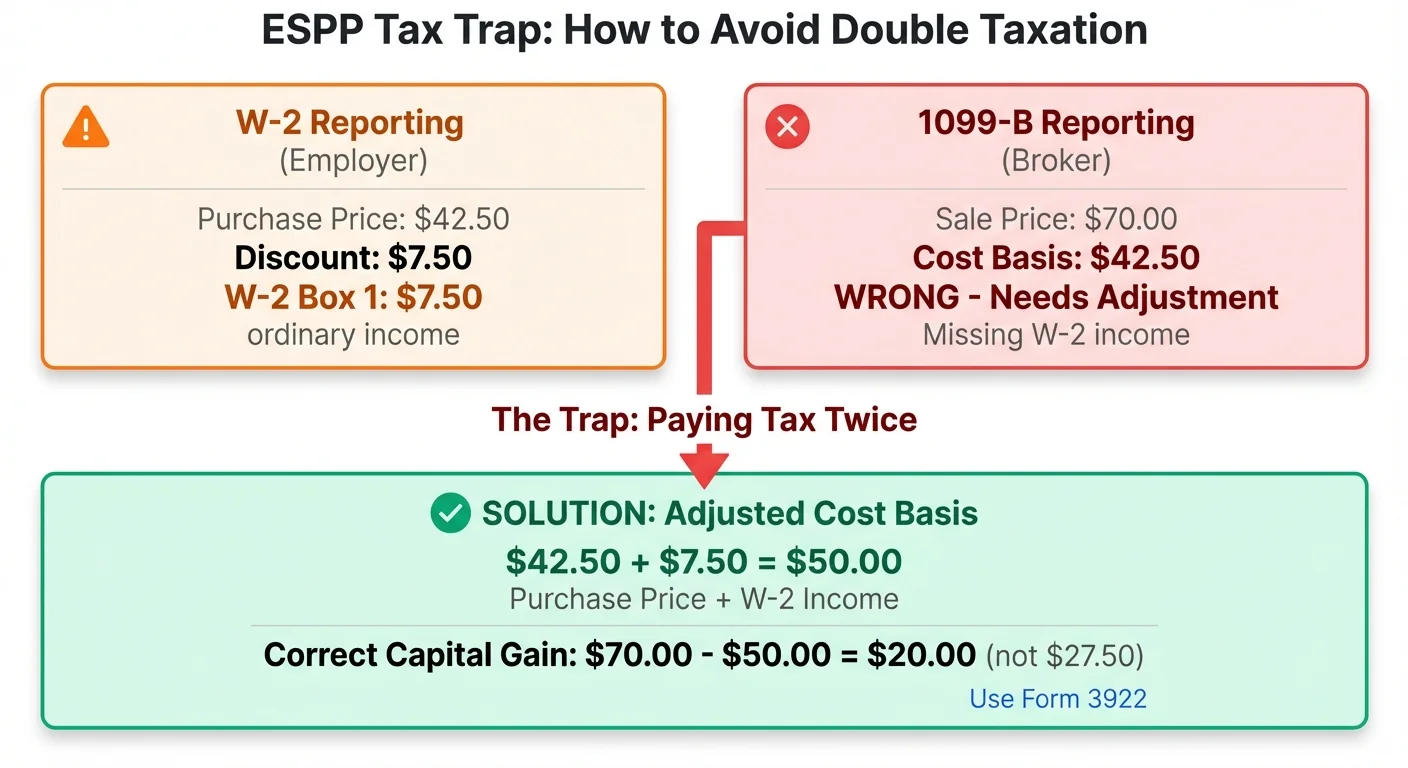

Critical Warning: The single most common ESPP tax mistake is failing to adjust your Form 1099-B cost basis. Your employer reports the discount as ordinary income on your W-2, but your broker reports the discounted purchase price as basis on Form 1099-B. Without adjustment, you'll pay tax twice on the same discount—once as ordinary income, once as capital gains.2

1. The Core Mechanics: Engineering a Triple-Digit Return

A "Qualified" ESPP (one that meets the requirements of IRS Section 423) is designed to give you an unfair advantage in the market.

The 15% Discount and the "Lookback" Alpha

Most plans offer a 15% discount off the Fair Market Value (FMV) of the stock. But the real wealth engine is the Lookback Provision. This feature allows the 15% discount to be applied to the lower of two prices:

- The FMV on the Offering Date (the start of the period).

- The FMV on the Purchase Date (the end of the period).

The Math of a 135% Immediate Return: Imagine your company's stock is $50 on the Offering Date and climbs to $100 by the Purchase Date.

- Without Lookback: You buy at $85 (15% off $100).

- With Lookback: You buy at $42.50 (15% off the $50 starting price).

- The Result: You instantly own a $100 asset for $42.50—a 135% gain before the stock even moves another cent.

According to Charles Schwab's ESPP analysis, 85% of qualified ESPPs offer the 15% discount, and plans with lookback provisions drive 48% median participation rates—nearly double those without lookback.3

Figure 1: The ESPP lookback provision — applying the 15% discount to the lower of two prices maximizes your immediate gain. In this example, buying at $42.50 (15% off $50) when the stock is worth $100 creates a 135% instant return.

The IRS $25,000 Contribution Ceiling

It is crucial to note that the IRS limits ESPP purchases to $25,000 of stock value per calendar year. This limit is based on the FMV of the stock on the Grant Date (Offering Date). If your plan offers a 15% discount, your actual payroll contribution limit is typically capped around $21,250 ($25k × 85%).4

| Scenario | Grant Date FMV | Max Shares (15% discount) | Contribution Required |

|---|---|---|---|

| Stock at $50/share | $25,000 | 500 shares | $21,250 |

| Stock at $100/share | $25,000 | 250 shares | $21,250 |

| Stock drops to $30/share | $25,000 | 833 shares (if limit allows) | $21,250 |

Source: NASPP ESPP $25,000 Limit Guide

Key Point: The $25,000 limit uses grant-date FMV per calendar year. Contribution caps like 85% of $25,000 can fail if stock declines, risking over-purchase and disqualification.5

2. Qualifying vs. Disqualifying Dispositions: The 2+1 Rule

The timing of your sale dictates whether your profits are taxed at high Ordinary Income rates (up to 37%) or low Long-Term Capital Gains rates (0%, 15%, or 20%).

The Golden Rule: The "2+1" Requirement

To achieve a Qualifying Disposition—the most tax-efficient outcome—you must hold your shares for:

- At least 2 years from the original Offering Date.

- At least 1 year from the actual Purchase Date.

Per IRS Section 423(a), both holding periods must be met simultaneously. Failure to meet either requirement triggers a Disqualifying Disposition, which forfeits favorable tax treatment.6

Figure 2: The ESPP 2+1 Rule — both holding period conditions must be satisfied simultaneously for qualifying disposition treatment. Meeting both requirements limits ordinary income to the discount amount and converts excess gains to favorable long-term capital gains rates.

Tax Breakdown Comparison

| Feature | Qualifying Disposition | Disqualifying Disposition |

|---|---|---|

| Ordinary Income Component | Limited to the lesser of the actual discount or your actual gain | The entire "spread" (FMV at purchase minus price paid) |

| Capital Gains Treatment | Remaining profit is Long-Term Capital Gain (0-20% rates) | Can be Short-Term or Long-Term depending on the hold time post-purchase |

| Tax Strategy | Maximizes after-tax wealth for long-term holders | Preferred only if you fear a significant stock price drop |

| Example: Purchase $42.50, FMV $50, Sell $70 | $7.50 ordinary + $20 LTCG | $17.50 ordinary + $10 capital gain |

Source: Wealth Enhancement Group ESPP Tax Rules

Real-World Tax Impact Example

Scenario: You purchase 100 shares at $42.50 (15% discount from $50 offering FMV), stock rises to $70/share by sale date.

| Calculation | Qualifying Disposition | Disqualifying Disposition |

|---|---|---|

| Purchase Price | $4,250 | $4,250 |

| Sale Price | $7,000 | $7,000 |

| Total Gain | $2,750 | $2,750 |

| Ordinary Income | $750 (lesser of discount or gain) | $1,750 (full spread if FMV $60 at purchase) |

| Capital Gain | $2,000 (LTCG) | $1,000 (STCG or LTCG) |

| Tax at 37% ordinary + 20% LTCG | $277.50 + $400 = $677.50 | $647.50 + $200 = $847.50 |

| Tax at 37% ordinary + 37% STCG | N/A | $647.50 + $370 = $1,017.50 |

| Net After-Tax | $6,322.50 | $5,982.50 (or $5,812.50 if STCG) |

Savings from Qualifying Disposition: $340-$510 depending on holding period.

Source: Charles Schwab ESPP Taxes Guide

3. The Double Taxation Trap: Why Your 1099-B is "Wrong"

This is the single most common error ESPP participants make. Double taxation occurs because of a reporting gap between your employer and your brokerage.

The Basis Adjustment Nightmare

When you sell ESPP shares, your employer reports the "discount" portion as ordinary income on your W-2 (Box 1). However, under IRS regulations, brokerage firms are often required to report your discounted purchase price as the cost basis on Form 1099-B.

The Trap: If you simply copy the 1099-B data into your tax software without an adjustment, you will pay:

- Ordinary Income Tax on the discount (via your W-2).

- Capital Gains Tax on that same discount (via the unadjusted 1099-B basis).

The Solution: Form 3922

You must use IRS Form 3922 (Transfer of Stock Acquired Through an ESPP) to calculate your Adjusted Cost Basis. When filing Form 8949, you must manually adjust the basis to include the amount already taxed as ordinary income on your W-2.7

Step-by-Step Basis Adjustment:

- Locate Form 3922 from your employer (issued by January 31 following purchase year)

- Identify the discount amount reported on your W-2 Box 1

- Calculate adjusted basis: Purchase Price + W-2 Ordinary Income = Adjusted Basis

- Report on Form 8949 with code "B" (basis adjustment) and explanation

Example Calculation:

- Purchase Price: $42.50/share

- W-2 Ordinary Income: $7.50/share (discount)

- Adjusted Basis: $50.00/share

- Sale Price: $70.00/share

- Capital Gain: $20.00/share (not $27.50/share)

Source: Schwab ESPP Tax Guide and NASPP Form 3922 Guide

Figure 4: The double taxation trap — your employer reports the discount as ordinary income on W-2, but your broker reports the discounted purchase price as basis on Form 1099-B. Without adjustment using Form 3922, you'll pay tax twice on the same discount amount.

Employer Reporting Requirements

Per IRS Publication 15-B, employers must:

| Requirement | Specification |

|---|---|

| W-2 Reporting | Report ESPP discount as ordinary income in Box 1 for disqualifying dispositions |

| Form 3922 Filing | File with IRS by February 28 (March 31 if electronic) |

| Form 3922 Distribution | Furnish Copy B to employee by January 31 |

| Qualifying Disposition Reporting | Report lesser of discount or sale gain on W-2 Box 1 |

Source: Orrick 2025 Annual Reporting Requirements

4. Advanced Considerations: AMT, SALT, and Withholding

Alternative Minimum Tax (AMT) and ESPPs

Unlike Incentive Stock Options (ISOs), ESPP purchases do not typically trigger an AMT adjustment at the time of purchase. However, the ordinary income recognized upon sale does count toward your Alternative Minimum Taxable Income (AMTI). With the 2026 AMT phaseout thresholds shifting, high earners must be vigilant about how large ESPP sales might interact with their AMT liability.8

2026 AMT Parameters (per IRS Revenue Procedure 2024-40):

| Component | Single Filer | Married Filing Jointly |

|---|---|---|

| Lower Bracket Rate | 26% (first $239,100 AMTI) | 26% (first $239,100 AMTI) |

| Upper Bracket Rate | 28% (above $239,100) | 28% (above $239,100) |

| Exemption Amount | $88,100 | $137,650 |

| Phase-out Begins | $578,150 AMTI | $578,150 AMTI |

AMT Mitigation Strategies:

- Hold for qualifying dispositions to minimize ordinary income

- Spread large ESPP sales across multiple tax years

- Consider selling minimal shares to cover taxes, retaining rest for hold

- Favor ESPPs over ISOs if AMT-exposed, as smaller discounts limit adjustment

Source: NCEO AMT and Stock Options Guide

The 2026 SALT Cap Shift

For employees in high-tax states (CA, NY, NJ), the State and Local Tax (SALT) deduction cap is projected to move to $40,000 in 2026 (up from $10,000). This provides a significant planning opportunity. Recognizing ESPP ordinary income in a year where you can maximize this higher deduction can significantly lower your effective tax rate.9

SALT Planning Example:

| Scenario | ESPP Ordinary Income | SALT Deduction | Effective Rate Reduction |

|---|---|---|---|

| 2025 Sale | $10,000 | $10,000 (capped) | Limited benefit |

| 2026 Sale | $10,000 | $10,000 (under $40K cap) | Full deduction benefit |

| High SALT State | $50,000 | $40,000 (capped) | $10K deduction vs $0 in 2025 |

Source: IRS Tax Reform Provisions

Supplemental Withholding Issues

When you sell in a disqualifying disposition, employers often withhold taxes at the 22% supplemental rate. If you are in the 32%, 35%, or 37% bracket, this 22% withholding will be insufficient, potentially leading to an underpayment penalty. Always check your total tax liability against your withholdings after a major sale.10

Per IRS Publication 15, supplemental wage withholding rates are:

| Total Supplemental Wages | Withholding Rate |

|---|---|

| Under $1,000,000 | 22% |

| $1,000,000+ | 37% |

Solution: Use the IRS Tax Withholding Estimator to calculate accurate withholding needs, or make estimated tax payments if withholding is insufficient.

Source: NASPP Withholding Guide

5. Strategic Playbook: When to Sell?

Your ESPP sale strategy depends on your risk tolerance, tax bracket, and financial goals.

The "Quick Flip" (Disqualifying Disposition)

Strategy: Sell immediately upon purchase.

Pros:

- Capture the 15% gain (minus ordinary income tax)

- Eliminate single-stock concentration risk

- Immediate liquidity

- No risk of stock price decline

Cons:

- Higher ordinary income tax (up to 37%)

- Forfeits long-term capital gains treatment

- May trigger underpayment penalties if withholding insufficient

Best For: Employees who need cash flow, fear stock volatility, or have high concentration risk.

The "Tax Optimizer" (Qualifying Disposition)

Strategy: Hold for the 2+1 period (2 years from offering, 1 year from purchase).

Pros:

- Limits ordinary income to lesser of discount or gain

- Converts excess appreciation to Long-Term Capital Gains (0-20%)

- Maximizes after-tax wealth

- Defers tax until sale

Cons:

- Requires holding through potential stock price declines

- Single-stock concentration risk

- Opportunity cost of locked capital

Best For: Long-term wealth builders, employees with diversified portfolios, those in high tax brackets.

The "De-risker" (Partial Sale Strategy)

Strategy: Sell enough shares to cover taxes and diversify, hold remainder for qualifying disposition.

Pros:

- Balances tax optimization with risk management

- Provides liquidity while maintaining tax benefits

- Reduces concentration risk

Cons:

- More complex tax reporting

- Requires careful basis tracking across multiple lots

Best For: Employees with significant ESPP holdings (>10-15% of net worth).

| Strategy | Holding Period | Tax Treatment | Risk Level |

|---|---|---|---|

| Quick Flip | Immediate sale | Full discount as ordinary income | Low (immediate diversification) |

| Tax Optimizer | 2+1 years | Discount limited, excess as LTCG | High (concentration risk) |

| De-risker | Partial hold | Mixed (ordinary + LTCG) | Medium |

Source: Fidelity Workplace Services ESPP Guide

Tax Season Checklist: ESPP Reporting

Based on guidance from Charles Schwab and Equity Methods:

Frequently Asked Questions

Q1: What happens if the stock price crashes below my purchase price?

In a Qualifying Disposition, if you sell for less than your purchase price, you recognize zero ordinary income. You would simply report a capital loss. In a Disqualifying Disposition, you might still owe ordinary income tax on the "spread" at purchase, even if the stock is currently worth less than that purchase price—a devastating "phantom income" scenario.

Source: IRS Publication 550 – Investment Income and Expenses

Q2: Does the $25,000 limit carry over?

Yes, to an extent. If you don't use your full $25,000 limit in one year, you may be able to "accrue" the unused portion for use in a subsequent year, depending on the specific language of your plan's offering periods. However, the limit resets each calendar year based on grant-date FMV.

Source: Equity Methods ESPP Accounting Guide

Q3: How do I know if my ESPP is "Qualified"?

Check your Plan Document for a reference to Internal Revenue Code Section 423. If it is "Non-Qualified," you will be taxed on the discount as soon as you purchase the shares (similar to an RSU), rather than waiting until you sell. Qualified plans offer tax deferral and potential capital gains treatment.

Source: IRS Section 423

Q4: Are ESPP contributions tax-deductible?

No. ESPP contributions are made with after-tax dollars. This is why the basis adjustment is so critical—you've already paid tax on the money used to buy the shares. The discount itself is taxed as ordinary income (either at purchase for non-qualified plans, or at sale for qualified plans).

Source: IRS Publication 525 – Taxable and Nontaxable Income

Q5: What if I leave the company before the purchase date?

Generally, if you leave the company, your contributions are refunded to you in cash, and you forfeit the right to purchase shares for that period. You do not owe taxes on the refunded contributions since they were already taxed when earned. However, you lose the opportunity to purchase shares at a discount.

Source: JPMorgan Workplace Solutions ESPP Guide

Q6: Can I sell ESPP shares immediately after purchase?

Yes, but this triggers a disqualifying disposition. You'll pay ordinary income tax on the full discount (purchase-date FMV minus purchase price), plus capital gains tax on any additional appreciation. While this provides immediate liquidity and eliminates concentration risk, it forfeits the tax benefits of a qualifying disposition.

Source: Wealth Enhancement Group ESPP Tax Rules

Q7: How does state tax apply to ESPP gains?

State tax treatment varies by state. In a qualifying disposition, only the discount portion is subject to state ordinary income tax, with excess gains taxed at state capital gains rates (which may be lower). In a disqualifying disposition, the full spread is subject to state ordinary income tax. Some states like Texas, Florida, and Nevada have no state income tax on equity.

Source: TurboTax ESPP Guide

Q8: What's the difference between ESPP and stock options (ISOs/NSOs)?

ESPPs allow you to purchase company stock at a discount through payroll deductions, while stock options give you the right to purchase shares at a set strike price. ESPPs are simpler (no exercise decision) but limited to $25,000/year. Stock options can provide larger potential gains but require exercise decisions and may trigger AMT. See our complete ISO vs NSO guide for detailed comparison.

Source: Cooley GO Stock Options Guide

Footnotes

Disclaimer: This guide discusses legal tax optimization strategies only. Tax evasion is illegal and is never recommended. This content is for educational purposes and does not constitute tax, legal, or financial advice. Tax laws vary by jurisdiction and change frequently. Always consult a qualified tax professional (CPA, tax attorney, enrolled agent) before making decisions based on this information. The authors accept no liability for actions taken based on this content.

Primary Sources

| Source | Type | URL |

|---|---|---|

| IRS Section 423 | Statute | law.cornell.edu/uscode/text/26/423 |

| IRS Form 3922 | Official Form | irs.gov/pub/irs-pdf/f3922.pdf |

| IRS Publication 525 | Official Guidance | irs.gov/publications/p525 |

| IRS Publication 15-B | Official Guidance | irs.gov/pub/irs-pdf/p15b.pdf |

| IRS Publication 550 | Official Guidance | irs.gov/publications/p550 |

| Charles Schwab | Financial Institution Guide | schwab.com/learn/story/espp-taxes |

| JPMorgan Workplace Solutions | Financial Institution Guide | jpmorganworkplacesolutions.com |

| Wealth Enhancement Group | Financial Advisory | wealthenhancement.com |

| NASPP | Professional Association | naspp.com |

| Equity Methods | Equity Compensation Consultancy | equitymethods.com |

| Orrick | Law Firm Analysis | orrick.com |

Last Updated: January 2026 | Research Team: VestingStrategy

Footnotes

-

IRS Section 423 governs qualified Employee Stock Purchase Plans, establishing the 15% discount limit, $25,000 annual cap, and holding period requirements for favorable tax treatment. ↩

-

Charles Schwab ESPP Tax Guide documents the double taxation trap: "Adjust Form 1099-B box 1e cost basis by W-2 income to prevent double taxation on sale." ↩

-

Charles Schwab analysis indicates 85% of qualified ESPPs offer 15% discount, with lookback provisions driving 48% median participation rates. ↩

-

NASPP ESPP $25,000 Limit Guide explains that the limit uses grant-date FMV per calendar year, not contribution amount. ↩

-

Equity Methods ESPP Accounting Guide details how contribution caps can fail if stock declines, risking over-purchase and disqualification. ↩

-

IRS Section 423(a) requires both holding periods (2 years from offering, 1 year from purchase) to be met simultaneously for qualifying disposition treatment. ↩

-

NASPP Form 3922 Guide explains employer filing requirements: "Employers must file Form 3922 for ESPP purchases/transfers under IRC Section 6039 to ensure accurate W-2 income reporting of discounts." ↩

-

IRS Revenue Procedure 2024-40 establishes 2026 AMT parameters: exemption amounts of $88,100 (single) and $137,650 (MFJ), with phaseouts beginning at $578,150 AMTI. ↩

-

IRS Tax Reform Provisions indicate the SALT deduction cap increases to $40,000 in 2026, providing planning opportunities for high-tax state residents. ↩

-

IRS Publication 15 specifies supplemental wage withholding at 22% (or 37% for amounts over $1 million), which may be insufficient for high-bracket taxpayers. ↩